Enterprise Data Protection (EDP) Solutions - A Global Market Overview

- Published: Aug 2025

- Pages: 470 | Charts: 405

- Report Code: ITM010

Global Enterprise Data Protection (EDP) Solutions Market Trends and Outlook

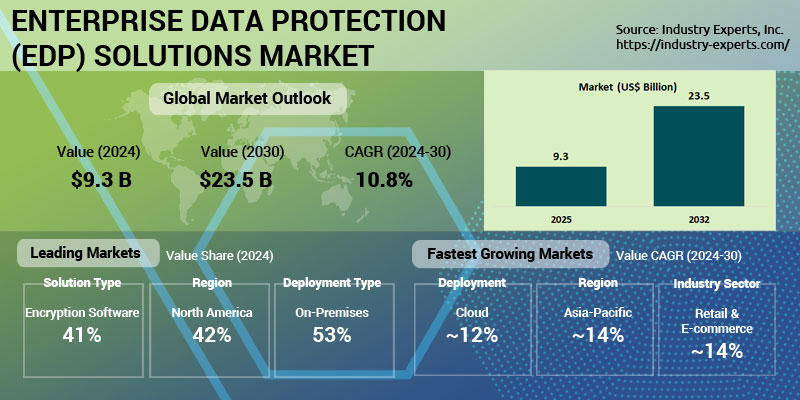

The global enterprise data protection (EDP) software market is entering a phase of rapid expansion, with market size projected to grow from US$9.33 billion in 2025 to over US$23.53 billion by 2034, registering a CAGR of 10.8%. This momentum is driven by a convergence of factors including stricter data protection regulations across major economies, heightened cyber threats such as ransomware and insider breaches, and the accelerated shift toward cloud-native, SaaS-based security solutions. Enterprises are increasingly prioritizing integrated platforms that combine encryption, data loss prevention (DLP), discovery, and classification capabilities to safeguard sensitive information across endpoints, networks, and multi-cloud environments.

The competitive landscape is both intense and dynamic, with established players such as Broadcom (Symantec), Microsoft, IBM, Forcepoint, Thales, and Trellix competing alongside innovative specialists in cloud data loss prevention and data security posture management. End-user priorities are evolving toward operational simplicity, automation, contextual intelligence, and seamless integration with productivity platforms. As regulatory obligations tighten and threats escalate, vendors that can deliver adaptable, policy-driven, and user-centric solutions are best positioned to capitalize on this growth cycle.

Key vendors in the enterprise data protection software market include Broadcom (Symantec Enterprise Division), Microsoft, IBM, Forcepoint, Thales, McAfee/Trellix, and Cisco, alongside niche providers such as Symmetry Systems and Digital Guardian that are shaping cloud-native and API-driven innovations.

Enterprise Data Protection (EDP) Solutions Regional Market Analysis

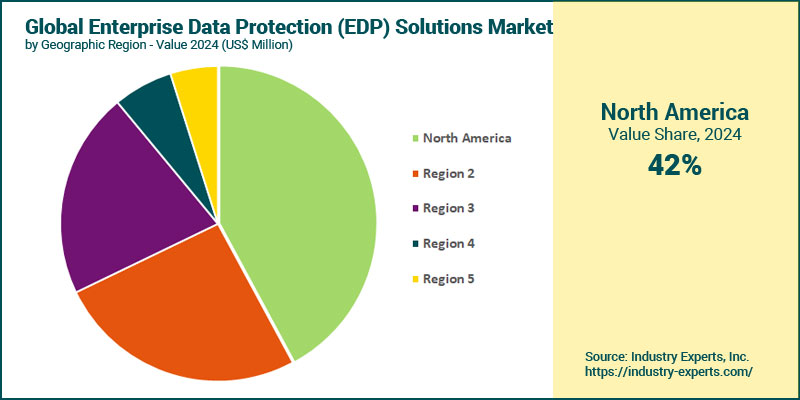

In 2025, North America holding the largest share at about 42% of the global enterprise data protection solutions market, driven by its mature regulatory environment, high cybersecurity spending, and early adoption of integrated DLP and encryption platforms. Europe follows, supported by stringent frameworks such as GDPR and sector-specific mandates in finance and healthcare. Asia-Pacific, currently the third-largest region, is projected to be the fastest-growing market during 2025-2034, expanding at a CAGR of 13.9%. This rapid growth is fueled by accelerating digital transformation, tightening data protection regulations in China, India, and ASEAN economies, and increased enterprise cloud adoption.

Enterprise Data Protection (EDP) Solutions Market Analysis by Solution Type

Encryption software is set to lead the global enterprise data protection solutions market with US$3.8 billion in revenue in 2025. Its dominance stems from its critical role in securing sensitive data across endpoints, cloud workloads, and storage environments, alongside expanding regulatory requirements for encryption at rest and in transit. Data loss prevention (DLP) solutions follow closely and are projected to be the fastest-growing segment during 2025-2034, registering an 11.7% CAGR. This growth is driven by the need for real-time monitoring, insider threat mitigation, and compliance with sector-specific data handling mandates. Integrated suites and other data protection software account for the remaining in 2025, offering unified discovery, classification, encryption, and policy enforcement capabilities. Although growing at a slower CAGR, this category is gaining traction as enterprises consolidate point solutions into holistic, policy-driven platforms for hybrid and multi-cloud environments.

Enterprise Data Protection (EDP) Solutions Market Analysis by Deployment Type

On-premises deployments account for about 52.7% of the global enterprise data protection solutions market in 2025. This leadership reflects entrenched security postures in highly regulated sectors such as government, banking, and healthcare, where data residency, control, and integration with legacy systems remain critical. Cloud deployments are expected to be the fastest-growing segment through 2034, expanding at a CAGR of 11.7%. This strong momentum is fueled by the scalability, cost-efficiency, and rapid deployment of SaaS-based and cloud-native platforms, as well as the shift toward hybrid work and multi-cloud security strategies. While on-premises adoption will continue to grow at a steady CAGR, the accelerating preference for cloud and hybrid models signals a long-term structural shift in enterprise data protection deployment strategies.

Enterprise Data Protection (EDP) Solutions Market Analysis by Company Type

In 2025, large enterprises will dominate the enterprise data protection solutions market with an estimated 63.9% share of global revenue. Their leadership is rooted in the need for highly scalable, integrated platforms capable of protecting complex, distributed environments spanning on-premises, cloud, and hybrid infrastructures, especially in sectors with stringent compliance demands. SMEs are forecast to be the fastest-growing customer segment during 2025-2034, posting a robust CAGR of 12.5%. This acceleration reflects their increasing adoption of SaaS-based, subscription-priced solutions that offer rapid deployment, lower upfront costs, and built-in compliance features, particularly appealing to resource-constrained IT teams.

Enterprise Data Protection (EDP) Solutions Market Analysis by Industry Sector

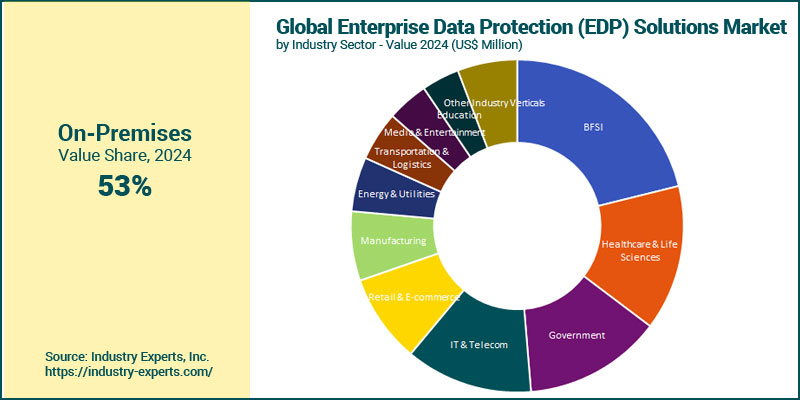

The BFSI sector will lead the global enterprise data protection solutions market with an estimated share of about 21.1% of total spending in 2025. This dominance is anchored in the sector's need to secure sensitive payment data, ensure PCI DSS compliance, and manage the risks of cyberattacks and insider threats across highly regulated, high-transaction environments. Healthcare and life sciences rank second, driven by stringent data privacy mandates for electronic health records, clinical trial data protection, and HIPAA/GDPR alignment. Looking ahead, retail and e-commerce is expected to be the fastest-growing sector between 2025 and 2034, recording a CAGR of 13.7%. This surge reflects the explosion of digital transactions, omnichannel engagement, and the need to secure sensitive customer data in real time across distributed cloud environments. Healthcare and life sciences closely follow as the second fastest-growing sector, fueled by telehealth expansion and cloud adoption in research and patient data management.

Enterprise Data Protection (EDP) Solutions Market Report Scope

This global report on Enterprise Data Protection (EDP) Solutions market analyzes the global and regional markets based on Solution Type, Deployment Type, Company Type and Industry Sector for the period 2025-2034 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Base Year: | 2025 | |

| Forecast Period: | 2025-2034 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 20+ |

Enterprise Data Protection (EDP) Solutions Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (Germany, the United Kingdom, France, Italy, the Netherlands, Spain, Russia, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru and Rest of South America)

- Middle East & Africa (the United Arab Emirates, South Africa, Egypt, Saudi Arabia, Morocco, Kuwait, Qatar and Rest of Middle East & Africa)

Enterprise Data Protection (EDP) Solutions Market by Solution Type

- Encryption Software

- Data Loss Prevention (DLP)

- Integrated Suites & Other Data Protection Software

Enterprise Data Protection (EDP) Solutions Market by Deployment Type

- On-Premises

- Cloud

Enterprise Data Protection (EDP) Solutions Market by Company Type

- Large Enterprises

- SMEs

Enterprise Data Protection (EDP) Solutions Market by Industry Sector

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Government

- IT & Telecom

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Media & Entertainment

- Education

- Other Industry Sectors

Enterprise Data Protection (EDP) Solutions Market Frequently Asked Questions (FAQs)

The market is valued at approximately US$9.3 billion in 2025 and is projected to grow to over US$23.5 billion by 2034.

North America is the largest market with about 42% of global revenue in 2025, supported by advanced regulatory compliance and high security investments.

Asia-Pacific is forecast to grow at the highest CAGR of 13.9% between 2025 and 2034, driven by regulatory mandates and rapid digital transformation.

Encryption software is the largest segment, accounting for 40.8% of market revenue in 2025 due to its central role in securing sensitive data across multiple environments.

Data loss prevention (DLP) solutions will grow at the highest rate of 11.7% CAGR, fueled by demand for real-time monitoring and insider threat mitigation.

Cloud deployment is the fastest-growing model, expected to reach nearly US$11.9 billion by 2034, thanks to scalability, flexibility, and alignment with hybrid work.

Leading vendors include Broadcom (Symantec), Microsoft, IBM, Forcepoint, Thales, and Trellix, alongside innovative specialists like Symmetry Systems and Digital Guardian.

PART A: GLOBAL MARKET PERSPECTIVE

1. EXECUTIVE SUMMARY

- A Roundup on Enterprise Data Protection (EDP) Solutions

- Market Segmentation for Enterprise Data Protection (EDP) Solutions

- Solution Types

- Deployment Types

- Company Types

- Industry Sectors

- Key Trends in Enterprise Data Protection (EDP) Solutions Market

2. INDUSTRY LANDSCAPE

- Global Enterprise Data Protection (EDP) Solutions Market Outlook

- Comprehensive Enterprise Data Protection (EDP) Solutions Industry Analysis - Growth Drivers and Inhibitors

- Growth Drivers

- Growth Inhibitors

- Market Entry Strategies for Enterprise Data Protection (EDP) Solutions Industry

- Startup Strategies for Enterprise Data Protection (EDP) Solutions Industry

- SWOT Analysis of Enterprise Data Protection (EDP) Solutions Industry

- Strengths

- Weaknesses

- Opportunities

- Threats

- Porter's Five Forces Analysis

- PESTEL Analysis

3. COMPETITIVE LANDSCAPE

- Market Positioning of Key Enterprise Data Protection (EDP) Solutions Companies

- Market Share Analysis of Enterprise Data Protection (EDP) Solutions Companies

- SWOT Analysis of Key Players in the Enterprise Data Protection (EDP) Solutions Industry

- Key Market Players

- Broadcom (Symantec Enterprise Division)

- Check Point Software

- Cisco

- Digital Guardian

- Egress

- Forcepoint

- GTB Technologies

- IBM

- McAfee (Trellix)

- Micro Focus (OpenText)

- Microsoft

- Netwrix

- Proofpoint

- Seclore

- Sophos

- Spirion

- Symmetry Systems

- Thales (Vormetric)

- Trend Micro

- Varonis

4. KEY BUSINESS & PRODUCT TRENDS

5. GLOBAL MARKET OVERVIEW

- Global Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Enterprise Data Protection (EDP) Solutions Solution Type Market Overview by Global Region

- Encryption Software

- Data Loss Prevention (DLP)

- Integrated Suites & Other Data Protection Software

- Global Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Enterprise Data Protection (EDP) Solutions Deployment Type Market Overview by Global Region

- On-Premises

- Cloud

- Global Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Enterprise Data Protection (EDP) Solutions Company Type Market Overview by Global Region

- Large Enterprises

- SMEs

- Global Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- Enterprise Data Protection (EDP) Solutions Industry Sector Market Overview by Global Region

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Government

- IT & Telecom

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Media & Entertainment

- Education

- Other Industry Sectors

PART B: REGIONAL MARKET PERSPECTIVE

- Global Enterprise Data Protection (EDP) Solutions Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- North American Enterprise Data Protection (EDP) Solutions Market Overview by Geographic Region

- North American Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- North American Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- North American Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- North American Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- Country-wise Analysis of North American Enterprise Data Protection (EDP) Solutions Market

- THE UNITED STATES

- United States Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- United States Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- United States Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- United States Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- CANADA

- Canadian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Canadian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Canadian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Canadian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- MEXICO

- Mexican Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Mexican Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Mexican Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Mexican Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

7. EUROPE

- European Enterprise Data Protection (EDP) Solutions Market Overview by Geographic Region

- European Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- European Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- European Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- European Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- Country-wise Analysis of European Enterprise Data Protection (EDP) Solutions Market

- GERMANY

- German Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- German Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- German Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- German Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- THE UNITED KINGDOM

- United Kingdom Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- United Kingdom Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- United Kingdom Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- United Kingdom Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- FRANCE

- French Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- French Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- French Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- French Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- ITALY

- Italian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Italian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Italian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Italian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- THE NETHERLANDS

- Dutch Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Dutch Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Dutch Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Dutch Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- SPAIN

- Spanish Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Spanish Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Spanish Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Spanish Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- RUSSIA

- Russian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Russian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Russian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Russian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- SWITZERLAND

- Swiss Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Swiss Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Swiss Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Swiss Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- REST OF EUROPE

- Rest of Europe Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Rest of Europe Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Rest of Europe Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Rest of Europe Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

8. ASIA-PACIFIC

- Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Geographic Region

- Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- Country-wise Analysis of Asia-Pacific Enterprise Data Protection (EDP) Solutions Market

- CHINA

- Chinese Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Chinese Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Chinese Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Chinese Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- JAPAN

- Japanese Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Japanese Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Japanese Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Japanese Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- INDIA

- Indian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Indian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Indian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Indian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- AUSTRALIA

- Australia Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Australia Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Australia Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Australia Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- SINGAPORE

- Singaporean Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Singaporean Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Singaporean Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Singaporean Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- SOUTH KOREA

- South Korean Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- South Korean Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- South Korean Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- South Korean Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- REST OF ASIA-PACIFIC

- Rest of Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Rest of Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Rest of Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Rest of Asia-Pacific Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

9. SOUTH AMERICA

- South American Enterprise Data Protection (EDP) Solutions Market Overview by Geographic Region

- South American Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- South American Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- South American Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- South American Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- Country-wise Analysis of South American Enterprise Data Protection (EDP) Solutions Market

- BRAZIL

- Brazilian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Brazilian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Brazilian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Brazilian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- ARGENTINA

- Argentine Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Argentine Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Argentine Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Argentine Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- COLOMBIA

- Colombian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Colombian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Colombian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Colombian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- CHILE

- Chilean Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Chilean Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Chilean Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Chilean Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- PERU

- Peruvian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Peruvian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Peruvian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Peruvian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- REST OF SOUTH AMERICA

- Rest of South America Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Rest of South America Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Rest of South America Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Rest of South America Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

10. MIDDLE EAST & AFRICA

- Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Geographic Region

- Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- Country-wise Analysis of Middle East & Africa Enterprise Data Protection (EDP) Solutions Market

- THE UNITED ARAB EMIRATES

- United Arab Emirates Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- United Arab Emirates Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- United Arab Emirates Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- United Arab Emirates Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- SOUTH AFRICA

- South African Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- South African Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- South African Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- South African Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- EGYPT

- Egyptian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Egyptian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Egyptian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Egyptian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- SAUDI ARABIA

- Saudi Arabian Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Saudi Arabian Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Saudi Arabian Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Saudi Arabian Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- MOROCCO

- Moroccan Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Moroccan Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Moroccan Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Moroccan Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- KUWAIT

- Kuwaiti Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Kuwaiti Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Kuwaiti Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Kuwaiti Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- QATAR

- Qatari Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Qatari Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Qatari Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Qatari Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

- REST OF MIDDLE EAST & AFRICA

- Rest of Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Solution Type

- Rest of Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Deployment Type

- Rest of Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Company Type

- Rest of Middle East & Africa Enterprise Data Protection (EDP) Solutions Market Overview by Industry Sector

PART C: INDUSTRY GUIDE

PART D: ANNEXURE

- RESEARCH METHODOLOGY

- FEEDBACK

Broadcom (Symantec Enterprise Division)

Check Point Software

Cisco

Digital Guardian

Egress

Forcepoint

GTB Technologies

IBM

McAfee (Trellix)

Micro Focus (OpenText)

Microsoft

Netwrix

Proofpoint

Seclore

Sophos

Spirion

Symmetry Systems

Thales (Vormetric)

Trend Micro

Varonis

Related Reports

| Report | Published | Price |

|---|---|---|

| Managed Storage Services - A Global Market Overview | Aug 21, 2025 | $5490 |

| Network Access Control (NAC) Hardware - A Global Market Overview | Aug 21, 2025 | $5490 |

| Artificial Intelligence (AI) in Mobile Apps Market - A Global Market Overview | Aug 21, 2025 | $5490 |

| Global Application Security Solutions Market - Types, Applications and Industry Sectors | Aug 20, 2025 | $5490 |