Managed Storage Services - A Global Market Overview

- Published: Aug 2025

- Pages: 484 | Charts: 411

- Report Code: ITM134

Global Managed Storage Services Market Trends and Outlook

The global managed storage services market is poised for significant expansion, advancing from an estimated US$27.2 billion in 2025 to nearly US$49.65 billion by 2032, registering a CAGR of 8.9%. Growth is being propelled by the dual imperatives of handling explosive data volumes and navigating increasingly stringent regulatory landscapes. Enterprises across industries are reimagining storage architectures to support AI workloads, real-time analytics, and ransomware-resilient backups, moving beyond traditional cost-saving outsourcing toward strategic, value-added engagements.

Asia-Pacific is set to lead growth momentum with a CAGR of 11.1% through 2032, driven by rapid SME digitalization and cloud-first mandates in India, China, and Southeast Asia. Mature markets such as North America and Western Europe, while growing more moderately, continue to modernize legacy estates through hybrid and multi-cloud deployments to meet evolving compliance and performance requirements. Across all regions, the rise of consumption-based delivery models, exemplified by Dell APEX and HPE GreenLake, is accelerating OPEX-driven adoption and expanding addressable markets, particularly for SMEs and vertical-specific deployments. The market's evolution is further supported by innovations in immutable and air-gapped backup solutions, advanced deduplication and compression algorithms, and AI-enabled capacity planning. BFSI remains the largest vertical, while Media & Entertainment is the fastest-growing, underscoring the diversification of storage use cases from compliance-critical workloads to high-throughput, content-rich environments.

Major vendors in the managed storage services market include IBM, Dell Technologies, Hewlett Packard Enterprise (HPE), NetApp, Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Pure Storage, and Rackspace Technology, alongside regional and niche managed service providers.

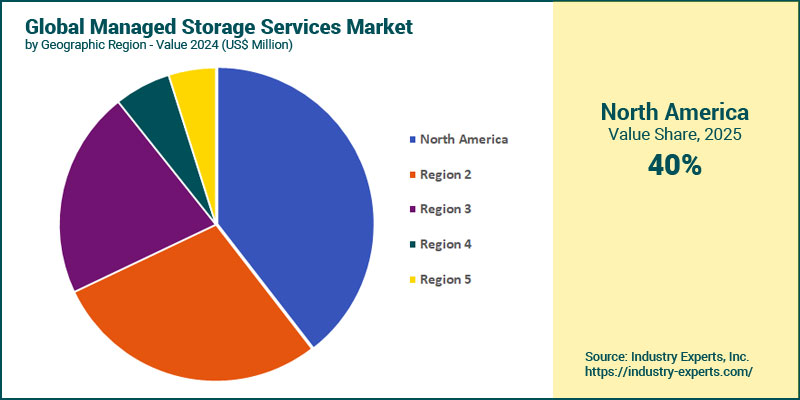

Managed Storage Services Regional Market Analysis

North America holds the largest share at 39.5% of the global managed storage services market in 2025, supported by a mature enterprise IT ecosystem, high compliance demands, and strong adoption of hybrid storage models. Europe follows, driven by GDPR-enforced retention policies and ongoing modernization of legacy storage infrastructure. The fastest-growing region between 2025 and 2032 is Asia-Pacific, projected to expand at a CAGR of 11.1%, fueled by rapid SME digitalization, cloud-first mandates in China and India, and the leapfrogging of on-premise storage procurement in emerging economies. South America is the second fastest-growing region, supported by increasing investment in resilient storage for BFSI and government sectors. These growth patterns reflect both the regulatory pull in mature markets and the digital acceleration in high-growth regions, amplified by the shift to consumption-based storage-as-a-service, ransomware-resilient architectures, and AI-driven storage analytics.

Managed Storage Services Market Analysis by Solution Type

In 2025, Storage Provisioning & Operations will be the largest solution type in the global managed storage services market, driven by enterprises' need to efficiently manage and scale hybrid NAS and SAN infrastructures to support data-intensive workloads. Backup and Restore Management follows closely, reflecting heightened ransomware threats and the prioritization of immutable, air-gapped backup capabilities. The fastest-growing segment from 2025 to 2032 is Compliance and Security Management, projected to expand at a CAGR of 10.9%, fueled by tightening global regulations, sector-specific data retention mandates, and cyber insurance requirements for certified storage environments. Backup and Restore Management is the second fastest-growing segment, supported by AI-powered anomaly detection, automated failover capabilities, and integration with multi-cloud disaster recovery strategies. These dynamics highlight the shift from purely operational storage management towards value-added, compliance-driven, and cyber-resilient service offerings.

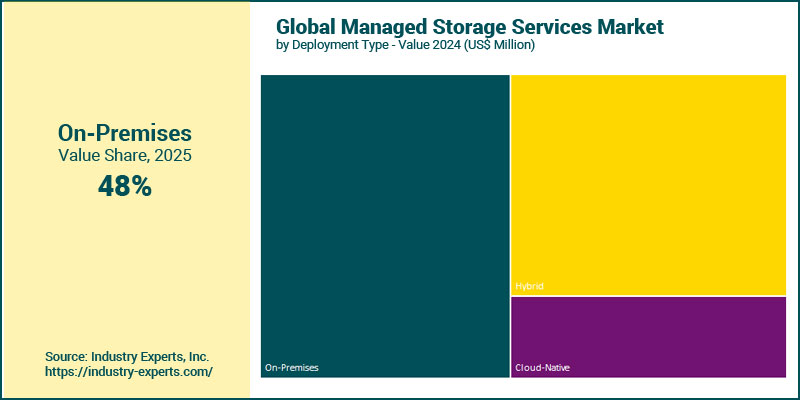

Managed Storage Services Market Analysis by Deployment Type

On-Premises deployments will account for the largest share of the global managed storage services market in 2025, underpinned by enterprises in regulated industries and government sectors that prioritize control, security, and compliance within their own data centers. Hybrid deployments follow closely, reflecting the growing need to balance workload agility with governance requirements through integrated on-premise and cloud architectures. The fastest-growing deployment type between 2025 and 2032 is Cloud-Native, forecast to rise at a CAGR of 10.9% to reach US$8 billion by 2032, propelled by cloud-first strategies, SaaS-based storage-as-a-service adoption, and integration with AI/analytics workloads. Hybrid is the second fastest-growing category, supported by multicloud orchestration, edge data integration, and the migration of legacy storage estates into more agile, consumption-based models. This shift underscores the market's trajectory toward flexible, OPEX-driven architectures while retaining specialized roles for on-premise systems in compliance-heavy sectors.

Managed Storage Services Market Analysis by Company Type

Large Enterprises will dominate the global managed storage services market in 2025, reflecting their extensive storage estates, stringent compliance requirements, and early adoption of hybrid and multi-cloud strategies. SMEs represent the fastest-growing company type between 2025 and 2032, with a CAGR of 10.6%. SME growth is fueled by rapid digitalization, especially in Asia-Pacific, and the preference for cloud-managed, subscription-based storage services that integrate capacity, encryption, and endpoint backup into a single contract. Large enterprises will continue to expand, driven by modernization of legacy infrastructure, integration of AI-driven storage analytics, and adoption of ransomware-resilient architectures at scale.

Managed Storage Services Market Analysis by Industry Sector

In 2025, BFSI will remain the largest industry sector in the global managed storage services market, supported by stringent regulatory mandates, the need for immutable, audit-compliant storage, and management of high-volume transactional data. Healthcare & Life Sciences ranks second, driven by strict compliance frameworks such as HIPAA and GDPR, the rapid growth of medical imaging data, and heightened investment in ransomware-resilient, encrypted storage infrastructures. Looking ahead, the fastest-growing sector between 2025 and 2032 is Media & Entertainment, projected to expand at a CAGR of 10.5% to reach US$3.2 billion, driven by the explosion of high-resolution streaming content and adoption of managed object storage for unstructured assets.

Managed Storage Services Market Report Scope

This global report on Managed Storage Services market analyzes the global and regional market based on Solution Type, Deployment Type, Company Type and Industry Sector for the period 2022-2032 with forecasts from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Analysis Period: | 2022-2032 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 25+ |

Managed Storage Services Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (Germany, the United Kingdom, France, Italy, the Netherlands, Spain, Russia, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru and Rest of South America)

- Middle East & Africa (the United Arab Emirates, South Africa, Egypt, Saudi Arabia, Morocco, Kuwait, Qatar and Rest of Middle East & Africa)

Managed Storage Services Market by Solution Type

- Storage Provisioning & Operations

- Backup and Restore Management

- Archiving and Retention Management

- Capacity Planning & Reporting

- Compliance and Security Management

Managed Storage Services Market by Deployment Type

- On-Premises

- Hybrid

- Cloud-Native

Managed Storage Services Market by Company Type

- Large Enterprises

- SMEs

Managed Storage Services Market by Industry Sector

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Government

- IT & Telecom

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Media & Entertainment

- Education

- Other Industry Sectors

Managed Storage Services Market Frequently Asked Questions (FAQs)

The market is projected to reach approximately US$49.6 billion by 2032, growing from US$27.25 billion in 2025 at a CAGR of 8.9%.

Asia-Pacific will record the fastest growth, with an 11.1% CAGR through 2032, driven by SME digitalization and cloud-first mandates in India, China, and Southeast Asia.

Major drivers include explosive data growth, regulatory compliance mandates, ransomware-resilient storage demand, hybrid multicloud adoption, and the shift toward consumption-based storage-as-a-service models.

Storage Provisioning & Operations is the largest segment in 2025, accounting for 35.2% of the market, while Compliance & Security Management is the fastest-growing at a 10.9% CAGR.

Cloud-Native managed storage services will expand at a 10.9% CAGR, driven by SaaS-based storage adoption, AI integration, and agility in scaling workloads.

BFSI is the largest sector in 2025, followed by Healthcare & Life Sciences, with Media & Entertainment being the fastest-growing due to high-volume content storage needs.

Key players include IBM, Dell Technologies, HPE, NetApp, AWS, Microsoft Azure, Google Cloud, Pure Storage, Rackspace Technology, along with regional managed service providers offering specialized solutions.

PART A: GLOBAL MARKET PERSPECTIVE

1. EXECUTIVE SUMMARY

- A Roundup on Managed Storage Services

- Market Segmentation for Managed Storage Services

- Solution Types

- Deployment Types

- Company Types

- Industry Sectors

- Key Trends in Managed Storage Services Market

2. INDUSTRY LANDSCAPE

- Global Managed Storage Services Market Outlook

- Comprehensive Managed Storage Services Industry Analysis - Growth Drivers and Inhibitors

- Growth Drivers

- Growth Inhibitors

- Market Entry Strategies for Managed Storage Services Industry

- Startup Strategies for Managed Storage Services Industry

- SWOT Analysis of Managed Storage Services Industry

- Strengths

- Weaknesses

- Opportunities

- Threats

- Porter's Five Forces Analysis

- PESTEL Analysis

3. COMPETITIVE LANDSCAPE

- Market Positioning of Key Managed Storage Services Companies

- Market Share Analysis of Managed Storage Services Companies

- SWOT Analysis of Key Players in the Managed Storage Services Industry

- Key Market Players

- Amazon Web Services (AWS)

- Atos

- Capgemini

- CenturyLink (Lumen Technologies)

- CGI

- Cisco

- Dell Technologies

- Dimension Data

- DXC Technology

- Fujitsu

- Google Cloud Platform (GCP)

- Hewlett Packard Enterprise (HPE)

- Hitachi Vantara

- IBM

- Infosys

- Iron Mountain

- Microsoft Azure

- NetApp

- NTT Ltd.

- Oracle

- Pure Storage

- Rackspace Technology

- Sungard Availability Services

- Tata Consultancy Services (TCS)

- Wipro

4. KEY BUSINESS & PRODUCT TRENDS

5. GLOBAL MARKET OVERVIEW

- Global Managed Storage Services Market Overview by Solution Type

- Managed Storage Services Solution Type Market Overview by Global Region

- Storage Provisioning & Operations

- Backup and Restore Management

- Archiving and Retention Management

- Capacity Planning & Reporting

- Compliance and Security Management

- Global Managed Storage Services Market Overview by Deployment Type

- Managed Storage Services Deployment Type Market Overview by Global Region

- On-Premises

- Hybrid

- Cloud-Native

- Global Managed Storage Services Market Overview by Company Type

- Managed Storage Services Company Type Market Overview by Global Region

- Large Enterprises

- SMEs

- Global Managed Storage Services Market Overview by Industry Sector

- Managed Storage Services Industry Sector Market Overview by Global Region

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Government

- IT & Telecom

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Media & Entertainment

- Education

- Other Industry Sectors

PART B: REGIONAL MARKET PERSPECTIVE

- Global Managed Storage Services Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- North American Managed Storage Services Market Overview by Geographic Region

- North American Managed Storage Services Market Overview by Solution Type

- North American Managed Storage Services Market Overview by Deployment Type

- North American Managed Storage Services Market Overview by Company Type

- North American Managed Storage Services Market Overview by Industry Sector

- Country-wise Analysis of North American Managed Storage Services Market

- THE UNITED STATES

- United States Managed Storage Services Market Overview by Solution Type

- United States Managed Storage Services Market Overview by Deployment Type

- United States Managed Storage Services Market Overview by Company Type

- United States Managed Storage Services Market Overview by Industry Sector

- CANADA

- Canadian Managed Storage Services Market Overview by Solution Type

- Canadian Managed Storage Services Market Overview by Deployment Type

- Canadian Managed Storage Services Market Overview by Company Type

- Canadian Managed Storage Services Market Overview by Industry Sector

- MEXICO

- Mexican Managed Storage Services Market Overview by Solution Type

- Mexican Managed Storage Services Market Overview by Deployment Type

- Mexican Managed Storage Services Market Overview by Company Type

- Mexican Managed Storage Services Market Overview by Industry Sector

7. EUROPE

- European Managed Storage Services Market Overview by Geographic Region

- European Managed Storage Services Market Overview by Solution Type

- European Managed Storage Services Market Overview by Deployment Type

- European Managed Storage Services Market Overview by Company Type

- European Managed Storage Services Market Overview by Industry Sector

- Country-wise Analysis of European Managed Storage Services Market

- GERMANY

- German Managed Storage Services Market Overview by Solution Type

- German Managed Storage Services Market Overview by Deployment Type

- German Managed Storage Services Market Overview by Company Type

- German Managed Storage Services Market Overview by Industry Sector

- THE UNITED KINGDOM

- United Kingdom Managed Storage Services Market Overview by Solution Type

- United Kingdom Managed Storage Services Market Overview by Deployment Type

- United Kingdom Managed Storage Services Market Overview by Company Type

- United Kingdom Managed Storage Services Market Overview by Industry Sector

- FRANCE

- French Managed Storage Services Market Overview by Solution Type

- French Managed Storage Services Market Overview by Deployment Type

- French Managed Storage Services Market Overview by Company Type

- French Managed Storage Services Market Overview by Industry Sector

- ITALY

- Italian Managed Storage Services Market Overview by Solution Type

- Italian Managed Storage Services Market Overview by Deployment Type

- Italian Managed Storage Services Market Overview by Company Type

- Italian Managed Storage Services Market Overview by Industry Sector

- THE NETHERLANDS

- Dutch Managed Storage Services Market Overview by Solution Type

- Dutch Managed Storage Services Market Overview by Deployment Type

- Dutch Managed Storage Services Market Overview by Company Type

- Dutch Managed Storage Services Market Overview by Industry Sector

- SPAIN

- Spanish Managed Storage Services Market Overview by Solution Type

- Spanish Managed Storage Services Market Overview by Deployment Type

- Spanish Managed Storage Services Market Overview by Company Type

- Spanish Managed Storage Services Market Overview by Industry Sector

- RUSSIA

- Russian Managed Storage Services Market Overview by Solution Type

- Russian Managed Storage Services Market Overview by Deployment Type

- Russian Managed Storage Services Market Overview by Company Type

- Russian Managed Storage Services Market Overview by Industry Sector

- SWITZERLAND

- Swiss Managed Storage Services Market Overview by Solution Type

- Swiss Managed Storage Services Market Overview by Deployment Type

- Swiss Managed Storage Services Market Overview by Company Type

- Swiss Managed Storage Services Market Overview by Industry Sector

- REST OF EUROPE

- Rest of Europe Managed Storage Services Market Overview by Solution Type

- Rest of Europe Managed Storage Services Market Overview by Deployment Type

- Rest of Europe Managed Storage Services Market Overview by Company Type

- Rest of Europe Managed Storage Services Market Overview by Industry Sector

8. ASIA-PACIFIC

- Asia-Pacific Managed Storage Services Market Overview by Geographic Region

- Asia-Pacific Managed Storage Services Market Overview by Solution Type

- Asia-Pacific Managed Storage Services Market Overview by Deployment Type

- Asia-Pacific Managed Storage Services Market Overview by Company Type

- Asia-Pacific Managed Storage Services Market Overview by Industry Sector

- Country-wise Analysis of Asia-Pacific Managed Storage Services Market

- CHINA

- Chinese Managed Storage Services Market Overview by Solution Type

- Chinese Managed Storage Services Market Overview by Deployment Type

- Chinese Managed Storage Services Market Overview by Company Type

- Chinese Managed Storage Services Market Overview by Industry Sector

- JAPAN

- Japanese Managed Storage Services Market Overview by Solution Type

- Japanese Managed Storage Services Market Overview by Deployment Type

- Japanese Managed Storage Services Market Overview by Company Type

- Japanese Managed Storage Services Market Overview by Industry Sector

- INDIA

- Indian Managed Storage Services Market Overview by Solution Type

- Indian Managed Storage Services Market Overview by Deployment Type

- Indian Managed Storage Services Market Overview by Company Type

- Indian Managed Storage Services Market Overview by Industry Sector

- AUSTRALIA

- Australia Managed Storage Services Market Overview by Solution Type

- Australia Managed Storage Services Market Overview by Deployment Type

- Australia Managed Storage Services Market Overview by Company Type

- Australia Managed Storage Services Market Overview by Industry Sector

- SINGAPORE

- Singaporean Managed Storage Services Market Overview by Solution Type

- Singaporean Managed Storage Services Market Overview by Deployment Type

- Singaporean Managed Storage Services Market Overview by Company Type

- Singaporean Managed Storage Services Market Overview by Industry Sector

- SOUTH KOREA

- South Korean Managed Storage Services Market Overview by Solution Type

- South Korean Managed Storage Services Market Overview by Deployment Type

- South Korean Managed Storage Services Market Overview by Company Type

- South Korean Managed Storage Services Market Overview by Industry Sector

- REST OF ASIA-PACIFIC

- Rest of Asia-Pacific Managed Storage Services Market Overview by Solution Type

- Rest of Asia-Pacific Managed Storage Services Market Overview by Deployment Type

- Rest of Asia-Pacific Managed Storage Services Market Overview by Company Type

- Rest of Asia-Pacific Managed Storage Services Market Overview by Industry Sector

9. SOUTH AMERICA

- South American Managed Storage Services Market Overview by Geographic Region

- South American Managed Storage Services Market Overview by Solution Type

- South American Managed Storage Services Market Overview by Deployment Type

- South American Managed Storage Services Market Overview by Company Type

- South American Managed Storage Services Market Overview by Industry Sector

- Country-wise Analysis of South American Managed Storage Services Market

- BRAZIL

- Brazilian Managed Storage Services Market Overview by Solution Type

- Brazilian Managed Storage Services Market Overview by Deployment Type

- Brazilian Managed Storage Services Market Overview by Company Type

- Brazilian Managed Storage Services Market Overview by Industry Sector

- ARGENTINA

- Argentine Managed Storage Services Market Overview by Solution Type

- Argentine Managed Storage Services Market Overview by Deployment Type

- Argentine Managed Storage Services Market Overview by Company Type

- Argentine Managed Storage Services Market Overview by Industry Sector

- COLOMBIA

- Colombian Managed Storage Services Market Overview by Solution Type

- Colombian Managed Storage Services Market Overview by Deployment Type

- Colombian Managed Storage Services Market Overview by Company Type

- Colombian Managed Storage Services Market Overview by Industry Sector

- CHILE

- Chilean Managed Storage Services Market Overview by Solution Type

- Chilean Managed Storage Services Market Overview by Deployment Type

- Chilean Managed Storage Services Market Overview by Company Type

- Chilean Managed Storage Services Market Overview by Industry Sector

- PERU

- Peruvian Managed Storage Services Market Overview by Solution Type

- Peruvian Managed Storage Services Market Overview by Deployment Type

- Peruvian Managed Storage Services Market Overview by Company Type

- Peruvian Managed Storage Services Market Overview by Industry Sector

- REST OF SOUTH AMERICA

- Rest of South America Managed Storage Services Market Overview by Solution Type

- Rest of South America Managed Storage Services Market Overview by Deployment Type

- Rest of South America Managed Storage Services Market Overview by Company Type

- Rest of South America Managed Storage Services Market Overview by Industry Sector

10. MIDDLE EAST & AFRICA

- Middle East & Africa Managed Storage Services Market Overview by Geographic Region

- Middle East & Africa Managed Storage Services Market Overview by Solution Type

- Middle East & Africa Managed Storage Services Market Overview by Deployment Type

- Middle East & Africa Managed Storage Services Market Overview by Company Type

- Middle East & Africa Managed Storage Services Market Overview by Industry Sector

- Country-wise Analysis of Middle East & Africa Managed Storage Services Market

- THE UNITED ARAB EMIRATES

- United Arab Emirates Managed Storage Services Market Overview by Solution Type

- United Arab Emirates Managed Storage Services Market Overview by Deployment Type

- United Arab Emirates Managed Storage Services Market Overview by Company Type

- United Arab Emirates Managed Storage Services Market Overview by Industry Sector

- SOUTH AFRICA

- South African Managed Storage Services Market Overview by Solution Type

- South African Managed Storage Services Market Overview by Deployment Type

- South African Managed Storage Services Market Overview by Company Type

- South African Managed Storage Services Market Overview by Industry Sector

- EGYPT

- Egyptian Managed Storage Services Market Overview by Solution Type

- Egyptian Managed Storage Services Market Overview by Deployment Type

- Egyptian Managed Storage Services Market Overview by Company Type

- Egyptian Managed Storage Services Market Overview by Industry Sector

- SAUDI ARABIA

- Saudi Arabian Managed Storage Services Market Overview by Solution Type

- Saudi Arabian Managed Storage Services Market Overview by Deployment Type

- Saudi Arabian Managed Storage Services Market Overview by Company Type

- Saudi Arabian Managed Storage Services Market Overview by Industry Sector

- MOROCCO

- Moroccan Managed Storage Services Market Overview by Solution Type

- Moroccan Managed Storage Services Market Overview by Deployment Type

- Moroccan Managed Storage Services Market Overview by Company Type

- Moroccan Managed Storage Services Market Overview by Industry Sector

- KUWAIT

- Kuwaiti Managed Storage Services Market Overview by Solution Type

- Kuwaiti Managed Storage Services Market Overview by Deployment Type

- Kuwaiti Managed Storage Services Market Overview by Company Type

- Kuwaiti Managed Storage Services Market Overview by Industry Sector

- QATAR

- Qatari Managed Storage Services Market Overview by Solution Type

- Qatari Managed Storage Services Market Overview by Deployment Type

- Qatari Managed Storage Services Market Overview by Company Type

- Qatari Managed Storage Services Market Overview by Industry Sector

- REST OF MIDDLE EAST & AFRICA

- Rest of Middle East & Africa Managed Storage Services Market Overview by Solution Type

- Rest of Middle East & Africa Managed Storage Services Market Overview by Deployment Type

- Rest of Middle East & Africa Managed Storage Services Market Overview by Company Type

- Rest of Middle East & Africa Managed Storage Services Market Overview by Industry Sector

PART C: INDUSTRY GUIDE

PART D: ANNEXURE

- RESEARCH METHODOLOGY

- FEEDBACK

Amazon Web Services (AWS)

Atos

Capgemini

CenturyLink (Lumen Technologies)

CGI

Cisco

Dell Technologies

Dimension Data

DXC Technology

Fujitsu

Google Cloud Platform (GCP)

Hewlett Packard Enterprise (HPE)

Hitachi Vantara

IBM

Infosys

Iron Mountain

Microsoft Azure

NetApp

NTT Ltd.

Oracle

Pure Storage

Rackspace Technology

Sungard Availability Services

Tata Consultancy Services (TCS)

Wipro

Related Reports

| Report | Published | Price |

|---|---|---|

| Content Delivery Network (CDN) - A Global Market Overview | Sep 24, 2025 | $5490 |

| Global AI Consulting and Support Services Market - Service Types, Company Types and Industry Sectors | Sep 23, 2025 | $5490 |

| Application Life-Cycle Management (ALM) Software - A Global Market Overview | Sep 23, 2025 | $5490 |

| Network Access Control (NAC) Hardware - A Global Market Overview | Aug 21, 2025 | $5490 |