Global Application Security Solutions Market - Types, Applications and Industry Sectors

- Published: Aug 2025

- Pages: 587 | Charts: 490

- Report Code: ITM009

Global Application Security Solutions Market Trends and Outlook

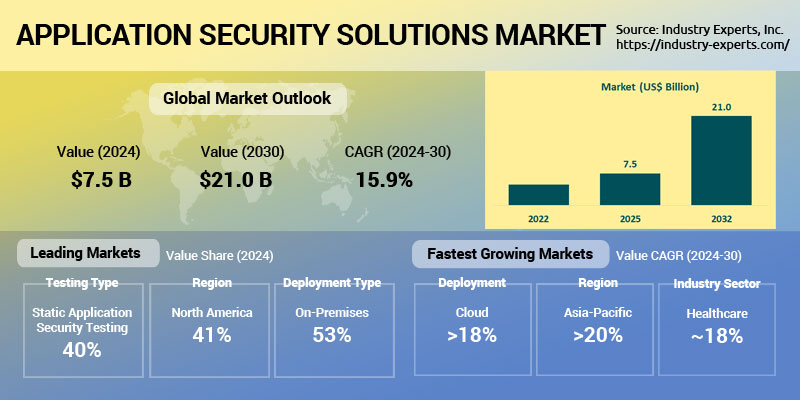

The global application security solutions market is poised for significant expansion, rising from an estimated US$7.5 billion in 2025 to about US$21 billion by 2032, reflecting a robust CAGR of 15.9%. This growth is being fueled by the escalating complexity of cyber threats, the shift toward cloud-native and API-driven architectures, and the mounting pressure of regulatory compliance across industries. With the traditional network perimeter disappearing, organizations are embedding security deeper into the software development lifecycle (SDLC), leveraging advanced tools such as SAST, DAST, RASP, IAST, and comprehensive Web Application and API Protection (WAAP) platforms. Integrated, developer-centric solutions are gaining traction as enterprises seek to reduce time-to-remediation, improve collaboration between development and security teams, and maintain compliance without sacrificing agility.

The market outlook is also shaped by a surge in API security adoption, supply chain vulnerability management, and the convergence of application security capabilities into unified platforms. Cloud-based deployments are expected to outpace on-premises growth as organizations embrace SaaS delivery for its scalability, ease of integration, and cost efficiency, particularly appealing to SMEs facing resource constraints. Going forward, vendors that combine breadth of capabilities with developer-friendly, automated, and compliance-ready features will be best positioned to capture this accelerating demand.

Leading players in the market include Checkmarx, Synopsys, Veracode, Palo Alto Networks, and Fortinet, alongside emerging innovators such as Snyk, GitLab, Contrast Security, and Salt Security that are redefining API protection and developer-first security.

Application Security Solutions Regional Market Analysis

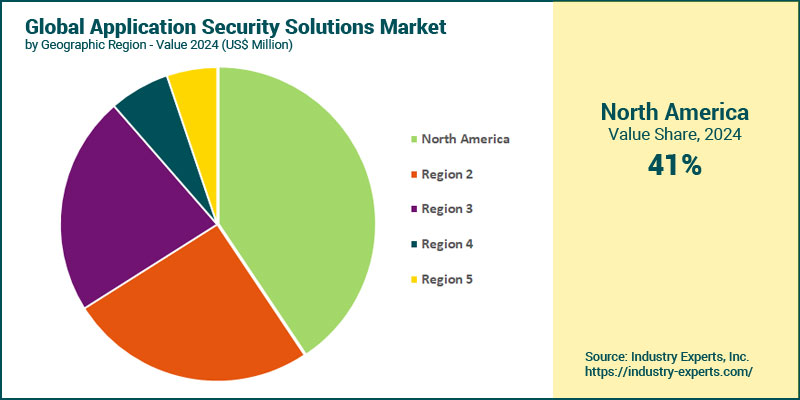

North America will continue to lead throughout the forecast period, accounting for the largest share in 2025 at roughly 40.6% of global demand, supported by mature cloud-first adoption, high regulatory compliance requirements such as SOX, HIPAA, and CCPA, and deep integration of DevSecOps practices across industries. Europe ranks as the second-largest market, driven by stringent GDPR enforcement, sector-specific mandates, and an accelerated shift toward API and supply chain security. Asia-Pacific will be the fastest-growing region, advancing at a notable 20.3% CAGR to reach US$6.1 billion by 2032, fueled by rapid SaaS adoption, financial services digitalization, and manufacturing sector modernization in countries such as China, India, and Japan. South America follows as the second-fastest-growing region, supported by increasing cloud migration and strengthening cybersecurity regulations, particularly in Brazil. Growth across these emerging regions is further amplified by heightened awareness of API security, the expansion of developer-first security tools, and the demand for integrated, cloud-delivered application security platforms.

Application Security Solutions Market Analysis by Testing Type

Static Application Security Testing (SAST) will remain the largest segment, accounting for 40% of global demand in 2025, supported by its critical role in early-stage vulnerability detection within the software development lifecycle (SDLC) and strong adoption across regulated industries. Dynamic Application Security Testing (DAST) will follow as the second-largest segment, driven by its effectiveness in identifying runtime vulnerabilities in web applications and APIs, especially in cloud-native and microservices environments. Dynamic Application Security Testing (DAST) will also register the fastest growth at 18.2% CAGR, fueled by the increasing complexity of web applications, API proliferation, and the need for real-time security validation. Runtime Application Self-Protection (RASP) will be the second-fastest-growing segment, as enterprises seek adaptive, in-memory defenses capable of protecting applications against zero-day attacks without impacting performance. Growth across all testing types is further supported by the shift toward integrated DevSecOps workflows, regulatory compliance pressures, and enterprise demand for consolidated application security platforms that improve visibility and reduce time-to-remediation.

Application Security Solutions Market Analysis by Application Type

Web application security will remain the dominant segment, accounting for 56.6% of total demand in 2025, driven by the need to safeguard business-critical web portals, SaaS platforms, and API-driven services from vulnerabilities across increasingly complex cloud-native and microservices architectures. Its growth is supported by the rising sophistication of web-based attacks, stricter compliance frameworks, and enterprise adoption of integrated Web Application and API Protection (WAAP) solutions. Mobile application security will be the fastest-growing segment, expanding at a CAGR of 17%. This acceleration is fueled by the rapid proliferation of mobile-first digital services, the growth of fintech and m-commerce ecosystems, and increasing threats from insecure mobile APIs and third-party SDKs. The adoption of DevSecOps and mobile-specific vulnerability scanning tools, combined with growing regulatory scrutiny over mobile payment and personal data protection, will further amplify demand in this segment.

Application Security Solutions Market Analysis by Deployment Type

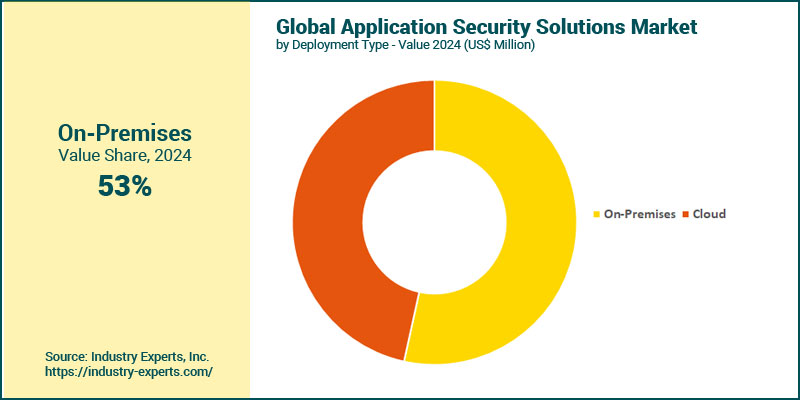

On-premises deployments will retain the largest share in 2025, cornering 53.4% of the global market, supported by adoption in highly regulated sectors such as finance, healthcare, and government, where data sovereignty, custom configurations, and integration with legacy infrastructure remain critical. Enterprises in these sectors often require granular control, dedicated infrastructure, and offline capabilities to meet compliance and operational demands. Cloud-based deployments, however, will be the fastest-growing segment, advancing at 18.4% CAGR through 2032. This rapid growth is driven by the scalability, ease of deployment, and cost-efficiency of SaaS and cloud-native application security platforms, as well as rising adoption among SMEs and agile enterprises adopting DevSecOps and CI/CD-driven development models. The shift toward multi-cloud and hybrid environments, combined with the increasing availability of integrated Web Application and API Protection (WAAP) and API security capabilities in cloud offerings, is accelerating demand for cloud-delivered solutions across industries.

Application Security Solutions Market Analysis by Company Type

Large enterprises will continue to hold the dominant share, driven by their complex multi-cloud environments, higher regulatory exposure, and need for comprehensive, integrated platforms covering SAST, DAST, RASP, IAST, and API security. These organizations are investing heavily in DevSecOps integration, supply chain security, and advanced runtime protection to defend against evolving application-layer threats. SMEs will be the fastest-growing segment, expanding at 17.5% CAGR. This growth is fueled by rising cyberattack risks targeting smaller businesses, the democratization of security through SaaS-based and developer-first solutions, and the affordability and scalability of cloud-delivered platforms. Many SMEs are adopting application security earlier in the development process to meet customer and regulatory demands, with particular emphasis on API security and automated vulnerability scanning integrated directly into CI/CD workflows.

Application Security Solutions Market Analysis by Industry Sector

The BFSI sector will remain the largest contributor, generating US$1.6 billion in 2025 of global demand. Growth in BFSI is driven by stringent financial data protection requirements, increasing adoption of cloud-native applications, and heightened investment in API and supply chain security to safeguard against fraud and cyberattacks. Government & defense will follow closely, underpinned by the need to protect critical infrastructure, meet national cybersecurity mandates, and secure expanding digital public services. Healthcare will be the fastest-growing sector, registering a CAGR of 18%, propelled by the digitization of patient care, telehealth expansion, and regulatory mandates such as HIPAA and GDPR requiring robust application-layer security. Retail & ecommerce will be the second-fastest-growing sector, fueled by the surge in online transactions, m-commerce, and omnichannel service delivery, which are increasing exposure to API-based attacks and payment data breaches. Across industries, the shift toward integrated DevSecOps practices, API security, and continuous compliance monitoring is shaping adoption trends, with sectors under high compliance scrutiny driving the most substantial investments.

Application Security Solutions Market Report Scope

This global report on Application Security Solutions market analyzes the global and regional market based on Testing Type, Application Type, Deployment Type, Company Type and Industry Sector for the period 2022-2032 with forecasts from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Analysis Period: | 2022-2032 | |

| Estimated Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 40+ |

Application Security Solutions Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (Germany, the United Kingdom, France, Italy, the Netherlands, Spain, Russia, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru and Rest of South America)

- Middle East & Africa (the United Arab Emirates, South Africa, Egypt, Saudi Arabia, Morocco, Kuwait, Qatar and Rest of Middle East & Africa)

Application Security Solutions Market by Testing Type

- Static Application Security Testing (SAST)

- Dynamic Application Security Testing (DAST)

- Runtime Application Self-Protection (RASP)

- Interactive Application Security Testing (IAST)

Application Security Solutions Market by Application Type

- Web Application Security

- Mobile Application Security

Application Security Solutions Market by Deployment Type

- Cloud

- On-Premises

Application Security Solutions Market by Company Type

- Large Enterprises

- SMEs

Application Security Solutions Market by Industry Sector

- Banking, Financial Services, and Insurance (BFSI)

- Government & Defense

- IT & Telecom

- Healthcare

- Retail & Ecommerce

- Manufacturing

- Energy & Utilities

- Education

- Media & Entertainment

- Transportation

- Other Industry Sectors

Application Security Solutions Market Frequently Asked Questions (FAQs)

The market is expected to grow from US$7.5 billion in 2025 to approximately US$21 billion by 2032, registering a CAGR of 15.9%.

North America is the largest market, accounting for 40.6% of global demand in 2025, driven by stringent regulations and advanced cloud adoption.

Asia-Pacific will lead growth with a CAGR of 20.3%, supported by rapid SaaS adoption, digital transformation, and growing API security awareness.

Static Application Security Testing (SAST) is the largest segment, representing 39.9% of the market in 2025, due to its role in early vulnerability detection.

BFSI is the leading sector with a 21.6% share in 2025, driven by regulatory compliance and the need to secure high-value financial applications.

Healthcare will see the highest CAGR of 18%, propelled by telehealth growth, digital patient data, and strict data privacy laws.

Major trends include API security investment, DevSecOps integration, unified application security platforms, supply chain risk mitigation, and growing adoption of cloud-based solutions.

PART A: GLOBAL MARKET PERSPECTIVE

1. EXECUTIVE SUMMARY

- A Roundup on Application Security Solutions

- Market Segmentation for Application Security Solutions

- Testing Types

- Application Types

- Deployment Types

- Company Types

- Industry Sectors

- Key Trends in Application Security Solutions Market

2. INDUSTRY LANDSCAPE

- Global Application Security Solutions Market Outlook

- Comprehensive Application Security Solutions Industry Analysis - Growth Drivers and Inhibitors

- Growth Drivers

- Growth Inhibitors

- Market Entry Strategies for Application Security Solutions Industry

- Startup Strategies for Application Security Solutions Industry

- SWOT Analysis of Application Security Solutions Industry

- Strengths

- Weaknesses

- Opportunities

- Threats

- Porter's Five Forces Analysis

- PESTEL Analysis

3. COMPETITIVE LANDSCAPE

- Market Positioning of Key Application Security Solutions Companies

- Market Share Analysis of Application Security Solutions Companies

- SWOT Analysis of Key Players in the Application Security Solutions Industry

- Key Market Players

- AppSealing

- Aqua Security

- Broadcom

- CAST Software

- Checkmarx Ltd.

- Cisco Systems Inc.

- Cloudflare

- Contrast Security Inc.

- Data Theorem

- Dynatrace Inc.

- F5 Inc.

- Fortinet Inc.

- GitLab

- GuardRails

- Guardsquare

- IBM Corporation

- ImmuniWeb SA

- Imperva

- Invicti Security Ltd.

- NowSecure

- Onapsis

- OpenText (CyberRes)

- Oracle Corporation

- Palo Alto Networks

- Positive Technologies

- Pradeo Security Systems

- Qualys Inc.

- Radware

- Rapid7 Inc.

- Reblaze

- ShiftLeft

- Sitelock LLC

- Snyk Limited

- SonarSource

- StackHawk

- Synopsys Inc.

- ThreatX

- Trend Micro Inc.

- Veracode

- Wallarm

- WhiteHat Security (Synopsys)

4. KEY BUSINESS & PRODUCT TRENDS

5. GLOBAL MARKET OVERVIEW

- Global Application Security Solutions Market Overview by Testing Type

- Application Security Solutions Testing Type Market Overview by Global Region

- Static Application Security Testing (SAST)

- Dynamic Application Security Testing (DAST)

- Runtime Application Self-Protection (RASP)

- Interactive Application Security Testing (IAST)

- Global Application Security Solutions Market Overview by Application Type

- Application Security Solutions Application Type Market Overview by Global Region

- Web Application Security

- Mobile Application Security

- Global Application Security Solutions Market Overview by Deployment Type

- Application Security Solutions Deployment Type Market Overview by Global Region

- Cloud

- On-Premises

- Global Application Security Solutions Market Overview by Company Type

- Application Security Solutions Company Type Market Overview by Global Region

- Large Enterprises

- SMEs

- Global Application Security Solutions Market Overview by Industry Sector

- Application Security Solutions Industry Sector Market Overview by Global Region

- Banking, Financial Services, and Insurance (BFSI)

- Government & Defense

- IT & Telecom

- Healthcare

- Retail & Ecommerce

- Manufacturing

- Energy & Utilities

- Education

- Media & Entertainment

- Transportation

- Other Industry Sectors

PART B: REGIONAL MARKET PERSPECTIVE

- Global Application Security Solutions Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- North American Application Security Solutions Market Overview by Geographic Region

- North American Application Security Solutions Market Overview by Testing Type

- North American Application Security Solutions Market Overview by Application Type

- North American Application Security Solutions Market Overview by Deployment Type

- North American Application Security Solutions Market Overview by Company Type

- North American Application Security Solutions Market Overview by Industry Sector

- Country-wise Analysis of North American Application Security Solutions Market

- THE UNITED STATES

- United States Application Security Solutions Market Overview by Testing Type

- United States Application Security Solutions Market Overview by Application Type

- United States Application Security Solutions Market Overview by Deployment Type

- United States Application Security Solutions Market Overview by Company Type

- United States Application Security Solutions Market Overview by Industry Sector

- CANADA

- Canadian Application Security Solutions Market Overview by Testing Type

- Canadian Application Security Solutions Market Overview by Application Type

- Canadian Application Security Solutions Market Overview by Deployment Type

- Canadian Application Security Solutions Market Overview by Company Type

- Canadian Application Security Solutions Market Overview by Industry Sector

- MEXICO

- Mexican Application Security Solutions Market Overview by Testing Type

- Mexican Application Security Solutions Market Overview by Application Type

- Mexican Application Security Solutions Market Overview by Deployment Type

- Mexican Application Security Solutions Market Overview by Company Type

- Mexican Application Security Solutions Market Overview by Industry Sector

7. EUROPE

- European Application Security Solutions Market Overview by Geographic Region

- European Application Security Solutions Market Overview by Testing Type

- European Application Security Solutions Market Overview by Application Type

- European Application Security Solutions Market Overview by Deployment Type

- European Application Security Solutions Market Overview by Company Type

- European Application Security Solutions Market Overview by Industry Sector

- Country-wise Analysis of European Application Security Solutions Market

- GERMANY

- German Application Security Solutions Market Overview by Testing Type

- German Application Security Solutions Market Overview by Application Type

- German Application Security Solutions Market Overview by Deployment Type

- German Application Security Solutions Market Overview by Company Type

- German Application Security Solutions Market Overview by Industry Sector

- THE UNITED KINGDOM

- United Kingdom Application Security Solutions Market Overview by Testing Type

- United Kingdom Application Security Solutions Market Overview by Application Type

- United Kingdom Application Security Solutions Market Overview by Deployment Type

- United Kingdom Application Security Solutions Market Overview by Company Type

- United Kingdom Application Security Solutions Market Overview by Industry Sector

- FRANCE

- French Application Security Solutions Market Overview by Testing Type

- French Application Security Solutions Market Overview by Application Type

- French Application Security Solutions Market Overview by Deployment Type

- French Application Security Solutions Market Overview by Company Type

- French Application Security Solutions Market Overview by Industry Sector

- ITALY

- Italian Application Security Solutions Market Overview by Testing Type

- Italian Application Security Solutions Market Overview by Application Type

- Italian Application Security Solutions Market Overview by Deployment Type

- Italian Application Security Solutions Market Overview by Company Type

- Italian Application Security Solutions Market Overview by Industry Sector

- THE NETHERLANDS

- Dutch Application Security Solutions Market Overview by Testing Type

- Dutch Application Security Solutions Market Overview by Application Type

- Dutch Application Security Solutions Market Overview by Deployment Type

- Dutch Application Security Solutions Market Overview by Company Type

- Dutch Application Security Solutions Market Overview by Industry Sector

- SPAIN

- Spanish Application Security Solutions Market Overview by Testing Type

- Spanish Application Security Solutions Market Overview by Application Type

- Spanish Application Security Solutions Market Overview by Deployment Type

- Spanish Application Security Solutions Market Overview by Company Type

- Spanish Application Security Solutions Market Overview by Industry Sector

- RUSSIA

- Russian Application Security Solutions Market Overview by Testing Type

- Russian Application Security Solutions Market Overview by Application Type

- Russian Application Security Solutions Market Overview by Deployment Type

- Russian Application Security Solutions Market Overview by Company Type

- Russian Application Security Solutions Market Overview by Industry Sector

- SWITZERLAND

- Swiss Application Security Solutions Market Overview by Testing Type

- Swiss Application Security Solutions Market Overview by Application Type

- Swiss Application Security Solutions Market Overview by Deployment Type

- Swiss Application Security Solutions Market Overview by Company Type

- Swiss Application Security Solutions Market Overview by Industry Sector

- REST OF EUROPE

- Rest of Europe Application Security Solutions Market Overview by Testing Type

- Rest of Europe Application Security Solutions Market Overview by Application Type

- Rest of Europe Application Security Solutions Market Overview by Deployment Type

- Rest of Europe Application Security Solutions Market Overview by Company Type

- Rest of Europe Application Security Solutions Market Overview by Industry Sector

8. ASIA-PACIFIC

- Asia-Pacific Application Security Solutions Market Overview by Geographic Region

- Asia-Pacific Application Security Solutions Market Overview by Testing Type

- Asia-Pacific Application Security Solutions Market Overview by Application Type

- Asia-Pacific Application Security Solutions Market Overview by Deployment Type

- Asia-Pacific Application Security Solutions Market Overview by Company Type

- Asia-Pacific Application Security Solutions Market Overview by Industry Sector

- Country-wise Analysis of Asia-Pacific Application Security Solutions Market

- CHINA

- Chinese Application Security Solutions Market Overview by Testing Type

- Chinese Application Security Solutions Market Overview by Application Type

- Chinese Application Security Solutions Market Overview by Deployment Type

- Chinese Application Security Solutions Market Overview by Company Type

- Chinese Application Security Solutions Market Overview by Industry Sector

- JAPAN

- Japanese Application Security Solutions Market Overview by Testing Type

- Japanese Application Security Solutions Market Overview by Application Type

- Japanese Application Security Solutions Market Overview by Deployment Type

- Japanese Application Security Solutions Market Overview by Company Type

- Japanese Application Security Solutions Market Overview by Industry Sector

- INDIA

- Indian Application Security Solutions Market Overview by Testing Type

- Indian Application Security Solutions Market Overview by Application Type

- Indian Application Security Solutions Market Overview by Deployment Type

- Indian Application Security Solutions Market Overview by Company Type

- Indian Application Security Solutions Market Overview by Industry Sector

- AUSTRALIA

- Australia Application Security Solutions Market Overview by Testing Type

- Australia Application Security Solutions Market Overview by Application Type

- Australia Application Security Solutions Market Overview by Deployment Type

- Australia Application Security Solutions Market Overview by Company Type

- Australia Application Security Solutions Market Overview by Industry Sector

- SINGAPORE

- Singaporean Application Security Solutions Market Overview by Testing Type

- Singaporean Application Security Solutions Market Overview by Application Type

- Singaporean Application Security Solutions Market Overview by Deployment Type

- Singaporean Application Security Solutions Market Overview by Company Type

- Singaporean Application Security Solutions Market Overview by Industry Sector

- SOUTH KOREA

- South Korean Application Security Solutions Market Overview by Testing Type

- South Korean Application Security Solutions Market Overview by Application Type

- South Korean Application Security Solutions Market Overview by Deployment Type

- South Korean Application Security Solutions Market Overview by Company Type

- South Korean Application Security Solutions Market Overview by Industry Sector

- REST OF ASIA-PACIFIC

- Rest of Asia-Pacific Application Security Solutions Market Overview by Testing Type

- Rest of Asia-Pacific Application Security Solutions Market Overview by Application Type

- Rest of Asia-Pacific Application Security Solutions Market Overview by Deployment Type

- Rest of Asia-Pacific Application Security Solutions Market Overview by Company Type

- Rest of Asia-Pacific Application Security Solutions Market Overview by Industry Sector

9. SOUTH AMERICA

- South American Application Security Solutions Market Overview by Geographic Region

- South American Application Security Solutions Market Overview by Testing Type

- South American Application Security Solutions Market Overview by Application Type

- South American Application Security Solutions Market Overview by Deployment Type

- South American Application Security Solutions Market Overview by Company Type

- South American Application Security Solutions Market Overview by Industry Sector

- Country-wise Analysis of South American Application Security Solutions Market

- BRAZIL

- Brazilian Application Security Solutions Market Overview by Testing Type

- Brazilian Application Security Solutions Market Overview by Application Type

- Brazilian Application Security Solutions Market Overview by Deployment Type

- Brazilian Application Security Solutions Market Overview by Company Type

- Brazilian Application Security Solutions Market Overview by Industry Sector

- ARGENTINA

- Argentine Application Security Solutions Market Overview by Testing Type

- Argentine Application Security Solutions Market Overview by Application Type

- Argentine Application Security Solutions Market Overview by Deployment Type

- Argentine Application Security Solutions Market Overview by Company Type

- Argentine Application Security Solutions Market Overview by Industry Sector

- COLOMBIA

- Colombian Application Security Solutions Market Overview by Testing Type

- Colombian Application Security Solutions Market Overview by Application Type

- Colombian Application Security Solutions Market Overview by Deployment Type

- Colombian Application Security Solutions Market Overview by Company Type

- Colombian Application Security Solutions Market Overview by Industry Sector

- CHILE

- Chilean Application Security Solutions Market Overview by Testing Type

- Chilean Application Security Solutions Market Overview by Application Type

- Chilean Application Security Solutions Market Overview by Deployment Type

- Chilean Application Security Solutions Market Overview by Company Type

- Chilean Application Security Solutions Market Overview by Industry Sector

- PERU

- Peruvian Application Security Solutions Market Overview by Testing Type

- Peruvian Application Security Solutions Market Overview by Application Type

- Peruvian Application Security Solutions Market Overview by Deployment Type

- Peruvian Application Security Solutions Market Overview by Company Type

- Peruvian Application Security Solutions Market Overview by Industry Sector

- REST OF SOUTH AMERICA

- Rest of South America Application Security Solutions Market Overview by Testing Type

- Rest of South America Application Security Solutions Market Overview by Application Type

- Rest of South America Application Security Solutions Market Overview by Deployment Type

- Rest of South America Application Security Solutions Market Overview by Company Type

- Rest of South America Application Security Solutions Market Overview by Industry Sector

10. MIDDLE EAST & AFRICA

- Middle East & Africa Application Security Solutions Market Overview by Geographic Region

- Middle East & Africa Application Security Solutions Market Overview by Testing Type

- Middle East & Africa Application Security Solutions Market Overview by Application Type

- Middle East & Africa Application Security Solutions Market Overview by Deployment Type

- Middle East & Africa Application Security Solutions Market Overview by Company Type

- Middle East & Africa Application Security Solutions Market Overview by Industry Sector

- Country-wise Analysis of Middle East & Africa Application Security Solutions Market

- THE UNITED ARAB EMIRATES

- United Arab Emirates Application Security Solutions Market Overview by Testing Type

- United Arab Emirates Application Security Solutions Market Overview by Application Type

- United Arab Emirates Application Security Solutions Market Overview by Deployment Type

- United Arab Emirates Application Security Solutions Market Overview by Company Type

- United Arab Emirates Application Security Solutions Market Overview by Industry Sector

- SOUTH AFRICA

- South African Application Security Solutions Market Overview by Testing Type

- South African Application Security Solutions Market Overview by Application Type

- South African Application Security Solutions Market Overview by Deployment Type

- South African Application Security Solutions Market Overview by Company Type

- South African Application Security Solutions Market Overview by Industry Sector

- EGYPT

- Egyptian Application Security Solutions Market Overview by Testing Type

- Egyptian Application Security Solutions Market Overview by Application Type

- Egyptian Application Security Solutions Market Overview by Deployment Type

- Egyptian Application Security Solutions Market Overview by Company Type

- Egyptian Application Security Solutions Market Overview by Industry Sector

- SAUDI ARABIA

- Saudi Arabian Application Security Solutions Market Overview by Testing Type

- Saudi Arabian Application Security Solutions Market Overview by Application Type

- Saudi Arabian Application Security Solutions Market Overview by Deployment Type

- Saudi Arabian Application Security Solutions Market Overview by Company Type

- Saudi Arabian Application Security Solutions Market Overview by Industry Sector

- MOROCCO

- Moroccan Application Security Solutions Market Overview by Testing Type

- Moroccan Application Security Solutions Market Overview by Application Type

- Moroccan Application Security Solutions Market Overview by Deployment Type

- Moroccan Application Security Solutions Market Overview by Company Type

- Moroccan Application Security Solutions Market Overview by Industry Sector

- KUWAIT

- Kuwaiti Application Security Solutions Market Overview by Testing Type

- Kuwaiti Application Security Solutions Market Overview by Application Type

- Kuwaiti Application Security Solutions Market Overview by Deployment Type

- Kuwaiti Application Security Solutions Market Overview by Company Type

- Kuwaiti Application Security Solutions Market Overview by Industry Sector

- QATAR

- Qatari Application Security Solutions Market Overview by Testing Type

- Qatari Application Security Solutions Market Overview by Application Type

- Qatari Application Security Solutions Market Overview by Deployment Type

- Qatari Application Security Solutions Market Overview by Company Type

- Qatari Application Security Solutions Market Overview by Industry Sector

- REST OF MIDDLE EAST & AFRICA

- Rest of Middle East & Africa Application Security Solutions Market Overview by Testing Type

- Rest of Middle East & Africa Application Security Solutions Market Overview by Application Type

- Rest of Middle East & Africa Application Security Solutions Market Overview by Deployment Type

- Rest of Middle East & Africa Application Security Solutions Market Overview by Company Type

- Rest of Middle East & Africa Application Security Solutions Market Overview by Industry Sector

PART C: INDUSTRY GUIDE

PART D: ANNEXURE

- RESEARCH METHODOLOGY

- FEEDBACK

AppSealing

Aqua Security

Broadcom

CAST Software

Checkmarx Ltd.

Cisco Systems Inc.

Cloudflare

Contrast Security Inc.

Data Theorem

Dynatrace Inc.

F5 Inc.

Fortinet Inc.

GitLab

GuardRails

Guardsquare

IBM Corporation

ImmuniWeb SA

Imperva

Invicti Security Ltd.

NowSecure

Onapsis

OpenText (CyberRes)

Oracle Corporation

Palo Alto Networks

Positive Technologies

Pradeo Security Systems

Qualys Inc.

Radware

Rapid7 Inc.

Reblaze

ShiftLeft

Sitelock LLC

Snyk Limited

SonarSource

StackHawk

Synopsys Inc.

ThreatX

Trend Micro Inc.

Veracode

Wallarm

WhiteHat Security (Synopsys)

Related Reports

| Report | Published | Price |

|---|---|---|

| Managed Storage Services - A Global Market Overview | Aug 21, 2025 | $5490 |

| Network Access Control (NAC) Hardware - A Global Market Overview | Aug 21, 2025 | $5490 |

| Artificial Intelligence (AI) in Mobile Apps Market - A Global Market Overview | Aug 21, 2025 | $5490 |

| Enterprise Data Protection (EDP) Solutions - A Global Market Overview | Aug 20, 2025 | $5490 |