Artificial Intelligence (AI) in Mobile Apps Market - A Global Market Overview

- Published: Aug 2025

- Pages: 568 | Charts: 504

- Report Code: ITM140

Global Artificial Intelligence (AI) in Mobile Apps Market Trends and Outlook

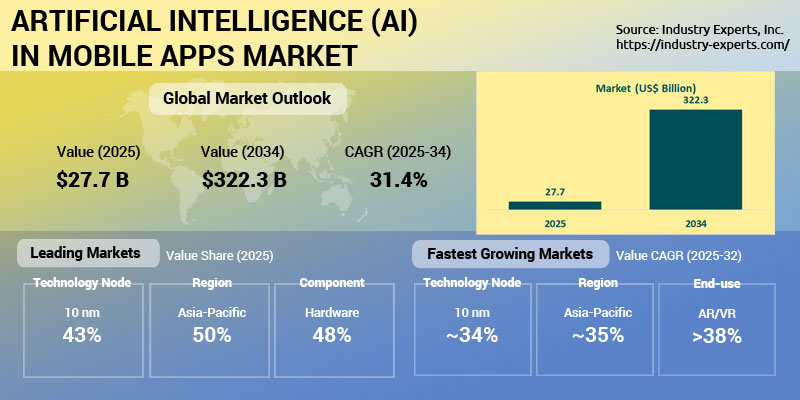

The Artificial Intelligence (AI) in Mobile Apps market is entering a transformative growth phase, driven by rapid advancements in on-device AI processing, real-time inference, and increasingly sophisticated AI frameworks. Valued at US$27.7 billion in 2025, the market is projected to exceed US$322 billion by 2034, registering a CAGR of over 31% during 2025-2034. Key growth catalysts include the widespread integration of AI-optimized chipsets such as Qualcomm's Snapdragon series and Apple's Neural Engine, adoption of transformer-based NLP and multimodal AI models, and the convergence of AI with Augmented Reality (AR) and Internet of Things (IoT) applications.

Market expansion is further fueled by rising enterprise and consumer demand for hyper-personalized, context-aware experiences across entertainment, e-commerce, healthcare, and productivity verticals. However, growth also brings challenges: regulatory compliance, data privacy concerns, and the shortage of AI development talent will require strategic adaptation. Companies that successfully integrate robust, privacy-first AI while ensuring compliance are poised to capture outsized market share in the decade ahead.

Key companies shaping the competitive landscape include Google, Apple, Microsoft, Amazon Web Services (AWS), Qualcomm, NVIDIA, Meta, MediaTek, IBM, Samsung Electronics, ByteDance, and Adobe, alongside specialized players such as Clarifai and SoundHound. These firms are driving innovation through hardware acceleration, pre-trained AI models, and developer ecosystems.

Artificial Intelligence (AI) in Mobile Apps Regional Market Analysis

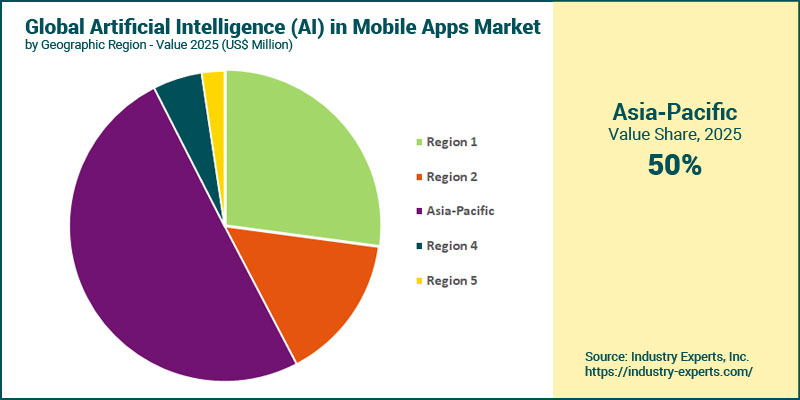

In 2025, Asia-Pacific leads the AI in Mobile Apps market accounting for 50.1% of total sales. This leadership is driven by widespread smartphone penetration, rapid 5G adoption, and strong uptake of AI-capable devices in China, India, and other emerging economies. North America holds the second-largest share, supported by a mature developer ecosystem, premium AI app monetization, and high investment in R&D. Asia-Pacific will also post the fastest growth during 2025-2034, with a CAGR of 34.8% billion by the end of the forecast period, fueled by leadership in AI+IoT and AI+AR integration. South America follows as the second fastest-growing region, supported by increasing connectivity, affordable smartphones, and AI-driven growth in fintech, retail, and health apps.

Artificial Intelligence (AI) in Mobile Apps Market Analysis by Component

Hardware is the largest revenue contributor in 2025, led by demand for AI-optimized chipsets and neural processing units enabling efficient on-device inference. Software ranks second, propelled by adoption of transformer-based NLP, computer vision, and predictive analytics frameworks. Over the forecast period, software will record the fastest CAGR, reaching US$125.5 billion by 2034 as developers increasingly adopt cross-platform AI SDKs, low-code pipelines, and embedded generative AI features.

Artificial Intelligence (AI) in Mobile Apps Market Analysis by Technology Node

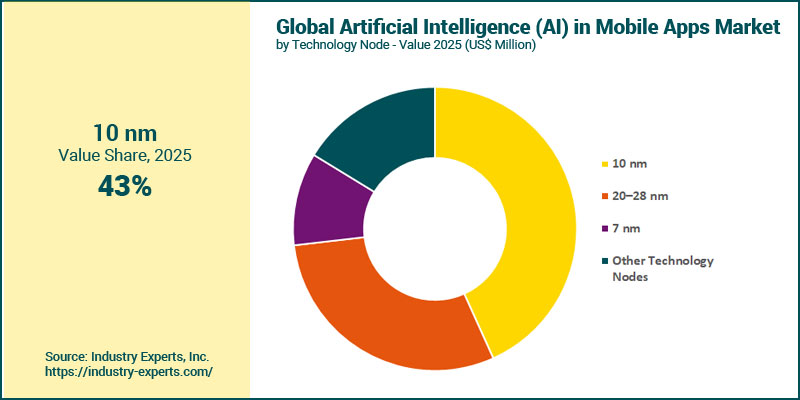

In 2025, 10 nm technology nodes account for the largest revenue share. Their dominance stems from widespread integration in AI-optimized mobile processors that balance performance and energy efficiency for on-device inference. The 20-28 nm segment follows, catering to cost-sensitive mid-range devices and emerging market adoption. Over the forecast period, 10 nm will also be the fastest-growing node, registering a CAGR of 34.3% from 2025 to 2034 and reaching nearly US$170 billion, supported by advancements in AI acceleration for NLP, computer vision, and multimodal applications. The 7 nm segment will expand at a robust CAGR, driven by premium device adoption and performance-intensive AI workloads.

Artificial Intelligence (AI) in Mobile Apps Market Analysis by Technology Type

In 2025, Natural Language Processing (NLP) holds the largest share at US$11.4 billion, representing 41.3% of the market. Its dominance is driven by widespread adoption in chatbots, voice assistants, real-time translation, and personalized content delivery in entertainment, e-commerce, and productivity apps. Machine Learning (ML) follows with 32.5% share (US$9 billion), underpinned by recommendation systems, predictive analytics, and adaptive user interfaces across industries. Over the forecast period, Computer Vision (CV) will emerge as the fastest-growing technology type, recording a CAGR of 36.1% from 2025 to 2034 to exceed US$48.8 billion, propelled by integration in AR-enhanced retail, biometric security, visual search, and health diagnostics. NLP will maintain strong growth at a 32.8% CAGR, driven by advances in transformer-based models and on-device language processing, while ML will grow at 29.8% CAGR, benefiting from its versatility across multiple verticals and its role in supporting multimodal AI solutions.

Artificial Intelligence (AI) in Mobile Apps Market Analysis by Application

Smartphones generate the highest revenues in 2025, driven by their ubiquity as the primary platform for AI-powered personalization, voice assistants, and multimedia enhancements. Automotive applications rank second, supported by the rise of AI-enabled driver assistance, in-vehicle voice control, and navigation systems. Over the forecast period, AR/VR will be the fastest-growing application area, registering a CAGR of 38.1% from 2025 to 2034, fueled by immersive AI-driven experiences in gaming, retail virtual try-ons, and industrial training. Automotive will follow closely, reaching about US$58.7 billion by 2034, propelled by advancements in autonomous driving, predictive maintenance, and personalized in-cabin experiences.

Artificial Intelligence (AI) in Mobile Apps Market Analysis by End-Use

In 2025, entertainment dominates, propelled by AI-enhanced content curation, personalized recommendations, and immersive multimedia experiences in gaming, streaming, and social platforms. Productivity applications follow, driven by AI-powered collaboration tools, workflow automation, and document intelligence in mobile environments. Over the forecast period, health and wellness will be the fastest-growing end-use, posting a CAGR of 36% from 2025 to 2034 to reach US$4.4 billion, underpinned by rising demand for personalized health monitoring, predictive analytics in wellness, and AI-powered virtual coaching.

Artificial Intelligence (AI) in Mobile Apps Market Report Scope

This global report on Network Access Control (NAC) Hardware market analyzes the global and regional market based on Product Type, Deployment Type, Company Type and Industry Sector for the period 2022-2032 with forecasts from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Base Year: | 2025 | |

| Forecast Period: | 2025-2034 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 15+ |

Artificial Intelligence (AI) in Mobile Apps Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (Germany, the United Kingdom, France, Italy, the Netherlands, Spain, Russia, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru and Rest of South America)

- Middle East & Africa (the United Arab Emirates, South Africa, Egypt, Saudi Arabia, Morocco, Kuwait, Qatar and Rest of Middle East & Africa)

Artificial Intelligence (AI) in Mobile Apps Market by Component

- Hardware

- Software

- Services

Artificial Intelligence (AI) in Mobile Apps Market by Technology Node

- 10 nm

- 20-28 nm

- 7 nm

- Other Technology Nodes

Artificial Intelligence (AI) in Mobile Apps Market by Technology Type

- Natural Language Processing (NLP)

- Machine Learning (ML)

- Computer Vision (CV)

- Other Technology Types

Artificial Intelligence (AI) in Mobile Apps Market by Application

- Smartphones

- Automotive

- Cameras

- AR/VR

- Drones

- Robotics

- Other Applications

Artificial Intelligence (AI) in Mobile Apps Market by End-Use

- Entertainment

- Productivity

- Photo & Video Apps

- Social Media, Communication & Connectivity

- E-commerce Shopping Apps

- Information & Utility

- Health & Wellness Apps

- Mobile Wallets

- Travel & Tourism Apps

- Other End-Uses

Artificial Intelligence (AI) in Mobile Apps Market Frequently Asked Questions (FAQs)

The market is projected to grow from US$27.7 billion in 2025 to over US$322 billion by 2034, registering a CAGR exceeding 31% during the forecast period.

Asia-Pacific leads with over 50% share, driven by massive smartphone adoption, rapid 5G rollout, and strong AI+IoT integration.

Software will record the highest CAGR at 33.6%, supported by adoption of cross-platform AI SDKs, low-code tools, and embedded generative AI capabilities.

Computer Vision (CV) is forecast to grow at 36.1% CAGR, fueled by AR-enhanced retail, biometric security, and visual search applications.

Major trends include on-device transformer-based models, multimodal AI integration, AI+AR+IoT convergence, regulatory-driven design, and privacy-first edge AI.

AR/VR leads with a CAGR of 38.1%, driven by immersive AI-driven experiences in gaming, retail, and industrial training.

Leading players include Google, Apple, AWS, Microsoft, Qualcomm, NVIDIA, Meta, MediaTek, IBM, Samsung Electronics, ByteDance, Adobe, Clarifai, and SoundHound.

PART A: GLOBAL MARKET PERSPECTIVE

1. EXECUTIVE SUMMARY

- A Roundup on Artificial Intelligence (AI) in Mobile Apps

- Market Segmentation for Artificial Intelligence (AI) in Mobile Apps

- Components

- Technology Nodes

- Technology Types

- Applications

- End-Uses

- Key Trends in Artificial Intelligence (AI) in Mobile Apps Market

2. INDUSTRY LANDSCAPE

- Global Artificial Intelligence (AI) in Mobile Apps Market Outlook

- Comprehensive Artificial Intelligence (AI) in Mobile Apps Industry Analysis - Growth Drivers and Inhibitors

- Growth Drivers

- Growth Inhibitors

- Market Entry Strategies for Artificial Intelligence (AI) in Mobile Apps Industry

- Startup Strategies for Artificial Intelligence (AI) in Mobile Apps Industry

- SWOT Analysis of Artificial Intelligence (AI) in Mobile Apps Industry

- Strengths

- Weaknesses

- Opportunities

- Threats

- Porter's Five Forces Analysis

- PESTEL Analysis

3. COMPETITIVE LANDSCAPE

- Market Positioning of Key Artificial Intelligence (AI) in Mobile Apps Companies

- Market Share Analysis of Artificial Intelligence (AI) in Mobile Apps Companies

- SWOT Analysis of Key Players in the Artificial Intelligence (AI) in Mobile Apps Industry

- Key Market Players

- Adobe

- Amazon Web Services (AWS)

- Apple

- ByteDance

- Cerebras Systems

- Clarifai

- H2O.ai

- IBM

- MediaTek

- Meta (Facebook)

- Microsoft

- NVIDIA

- Qualcomm

- Samsung Electronics

- Snap Inc.

- SoundHound

- Spotify

- Zoom

4. KEY BUSINESS & PRODUCT TRENDS

5. GLOBAL MARKET OVERVIEW

- Global Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Artificial Intelligence (AI) in Mobile Apps Component Market Overview by Global Region

- Hardware

- Software

- Services

- Global Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Artificial Intelligence (AI) in Mobile Apps Technology Node Market Overview by Global Region

- 10 nm

- 20-28 nm

- 7 nm

- Other Technology Nodes

- Global Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Artificial Intelligence (AI) in Mobile Apps Technology Type Market Overview by Global Region

- Natural Language Processing (NLP)

- Machine Learning (ML)

- Computer Vision (CV)

- Other Technology Types

- Global Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Artificial Intelligence (AI) in Mobile Apps Application Market Overview by Global Region

- Smartphones

- Automotive

- Cameras

- AR/VR

- Drones

- Robotics

- Other Applications

- Global Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- Artificial Intelligence (AI) in Mobile Apps End-Use Market Overview by Global Region

- Entertainment

- Productivity

- Photo & Video Apps

- Social Media, Communication & Connectivity

- E-commerce Shopping Apps

- Information & Utility

- Health & Wellness Apps

- Mobile Wallets

- Travel & Tourism Apps

- Other End-Uses

PART B: REGIONAL MARKET PERSPECTIVE

- Global Artificial Intelligence (AI) in Mobile Apps Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- North American Artificial Intelligence (AI) in Mobile Apps Market Overview by Geographic Region

- North American Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- North American Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- North American Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- North American Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- North American Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- Country-wise Analysis of North American Artificial Intelligence (AI) in Mobile Apps Market

- THE UNITED STATES

- United States Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- United States Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- United States Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- United States Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- United States Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- CANADA

- Canadian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Canadian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Canadian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Canadian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Canadian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- MEXICO

- Mexican Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Mexican Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Mexican Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Mexican Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Mexican Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

7. EUROPE

- European Artificial Intelligence (AI) in Mobile Apps Market Overview by Geographic Region

- European Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- European Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- European Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- European Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- European Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- Country-wise Analysis of European Artificial Intelligence (AI) in Mobile Apps Market

- GERMANY

- German Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- German Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- German Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- German Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- German Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- THE UNITED KINGDOM

- United Kingdom Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- United Kingdom Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- United Kingdom Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- United Kingdom Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- United Kingdom Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- FRANCE

- French Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- French Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- French Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- French Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- French Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- ITALY

- Italian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Italian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Italian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Italian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Italian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- THE NETHERLANDS

- Dutch Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Dutch Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Dutch Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Dutch Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Dutch Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- SPAIN

- Spanish Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Spanish Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Spanish Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Spanish Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Spanish Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- RUSSIA

- Russian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Russian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Russian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Russian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Russian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- SWITZERLAND

- Swiss Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Swiss Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Swiss Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Swiss Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Swiss Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- REST OF EUROPE

- Rest of Europe Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Rest of Europe Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Rest of Europe Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Rest of Europe Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Rest of Europe Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

8. ASIA-PACIFIC

- Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Geographic Region

- Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- Country-wise Analysis of Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market

- CHINA

- Chinese Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Chinese Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Chinese Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Chinese Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Chinese Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- JAPAN

- Japanese Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Japanese Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Japanese Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Japanese Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Japanese Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- INDIA

- Indian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Indian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Indian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Indian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Indian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- AUSTRALIA

- Australia Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Australia Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Australia Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Australia Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Australia Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- SINGAPORE

- Singaporean Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Singaporean Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Singaporean Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Singaporean Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Singaporean Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- SOUTH KOREA

- South Korean Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- South Korean Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- South Korean Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- South Korean Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- South Korean Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- REST OF ASIA-PACIFIC

- Rest of Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Rest of Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Rest of Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Rest of Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Rest of Asia-Pacific Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

9. SOUTH AMERICA

- South American Artificial Intelligence (AI) in Mobile Apps Market Overview by Geographic Region

- South American Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- South American Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- South American Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- South American Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- South American Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- Country-wise Analysis of South American Artificial Intelligence (AI) in Mobile Apps Market

- BRAZIL

- Brazilian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Brazilian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Brazilian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Brazilian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Brazilian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- ARGENTINA

- Argentine Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Argentine Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Argentine Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Argentine Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Argentine Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- COLOMBIA

- Colombian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Colombian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Colombian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Colombian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Colombian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- CHILE

- Chilean Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Chilean Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Chilean Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Chilean Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Chilean Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- PERU

- Peruvian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Peruvian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Peruvian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Peruvian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Peruvian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- REST OF SOUTH AMERICA

- Rest of South America Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Rest of South America Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Rest of South America Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Rest of South America Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Rest of South America Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

10. MIDDLE EAST & AFRICA

- Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Geographic Region

- Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- Country-wise Analysis of Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market

- THE UNITED ARAB EMIRATES

- United Arab Emirates Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- United Arab Emirates Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- United Arab Emirates Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- United Arab Emirates Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- United Arab Emirates Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- SOUTH AFRICA

- South African Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- South African Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- South African Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- South African Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- South African Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- EGYPT

- Egyptian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Egyptian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Egyptian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Egyptian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Egyptian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- SAUDI ARABIA

- Saudi Arabian Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Saudi Arabian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Saudi Arabian Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Saudi Arabian Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Saudi Arabian Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- MOROCCO

- Moroccan Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Moroccan Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Moroccan Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Moroccan Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Moroccan Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- KUWAIT

- Kuwaiti Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Kuwaiti Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Kuwaiti Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Kuwaiti Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Kuwaiti Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- QATAR

- Qatari Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Qatari Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Qatari Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Qatari Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Qatari Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

- REST OF MIDDLE EAST & AFRICA

- Rest of Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Component

- Rest of Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Node

- Rest of Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Technology Type

- Rest of Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by Application

- Rest of Middle East & Africa Artificial Intelligence (AI) in Mobile Apps Market Overview by End-Use

PART C: INDUSTRY GUIDE

PART D: ANNEXURE

- RESEARCH METHODOLOGY

- FEEDBACK

Adobe

Amazon Web Services (AWS)

Apple

ByteDance

Cerebras Systems

Clarifai

Google

H2O.ai

IBM

MediaTek

Meta (Facebook)

Microsoft

NVIDIA

Qualcomm

Samsung Electronics

Snap Inc.

SoundHound

Spotify

Zoom

Related Reports

| Report | Published | Price |

|---|---|---|

| Content Delivery Network (CDN) - A Global Market Overview | Sep 24, 2025 | $5490 |

| Global AI Consulting and Support Services Market - Service Types, Company Types and Industry Sectors | Sep 23, 2025 | $5490 |

| Application Life-Cycle Management (ALM) Software - A Global Market Overview | Sep 23, 2025 | $5490 |

| Managed Storage Services - A Global Market Overview | Aug 21, 2025 | $5490 |