Network Access Control (NAC) Hardware - A Global Market Overview

- Published: Aug 2025

- Pages: 467 | Charts: 405

- Report Code: ITM139

Global Network Access Control (NAC) Hardware Market Trends and Outlook

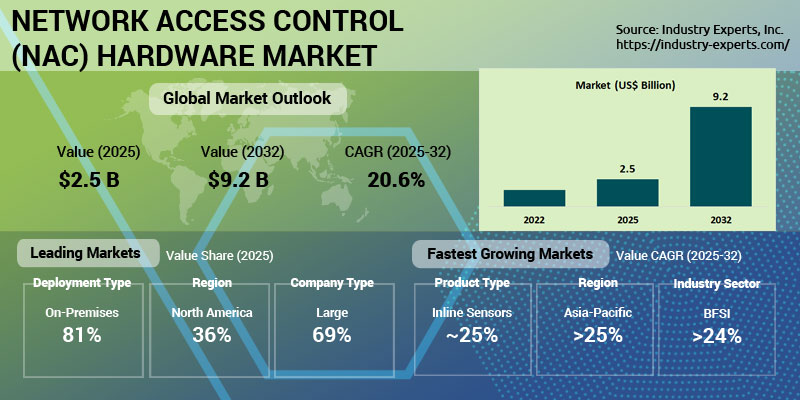

The Network Access Control (NAC) hardware market is entering a phase of robust expansion, underpinned by the surge in connected devices, stricter regulatory frameworks, and the enterprise shift toward adaptive, Zero Trust-aligned security. Valued at an estimated US$2.5 billion in 2025, the market is projected to surpass US$9.2 billion by 2032, advancing at a CAGR of 20.6%. NAC appliances remain the cornerstone of policy enforcement at the network perimeter, with accelerating adoption in hybrid, distributed, and critical infrastructure environments. North America maintains the largest share, led by industries under stringent compliance regimes, while Asia-Pacific is the fastest-growing region as manufacturing, BFSI, and government sectors scale deployments to secure IoT and OT endpoints.

Growth momentum is reinforced by rapid innovation. Vendors are embedding AI-driven behavioral analytics, machine learning, and real-time anomaly detection into hardware appliances, enabling adaptive access control that can respond dynamically to lateral threats and insider risks. Next-generation NAC devices are also evolving to support Software-Defined Perimeter (SDP) and Zero Trust Network Access (ZTNA) frameworks, offering continuous risk assessment, micro-segmentation, and interoperability with EDR, SIEM, and identity management systems. While high upfront costs and skills shortages can present barriers, particularly for SMEs, the market is benefiting from a widening portfolio of cost-effective, cloud-managed NAC hardware designed for faster deployment and simplified operations.

Leading companies in the NAC hardware market include Cisco Systems, HPE Aruba Networks, Fortinet, Juniper Networks, Forescout Technologies, Huawei, Palo Alto Networks, Check Point Software, Extreme Networks, and Sophos, alongside notable specialists such as Portnox and Pulse Secure (Ivanti).

Network Access Control (NAC) Hardware Regional Market Analysis

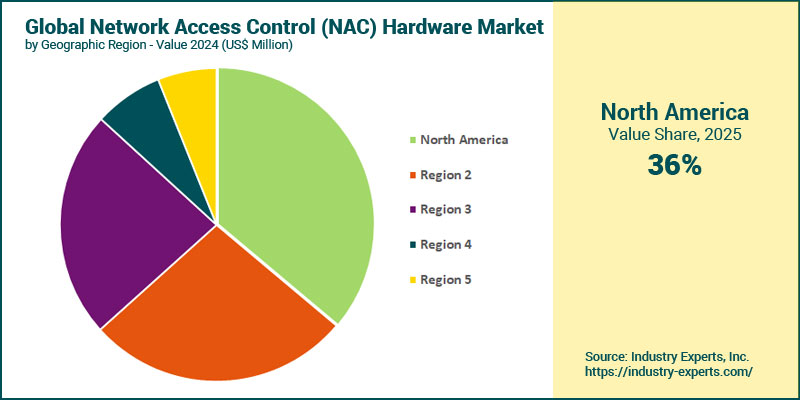

North America retaining the largest share at 36% of the global Network Access Control (NAC) hardware market in 2025, driven by stringent cybersecurity compliance frameworks such as NIST, HIPAA, and CMMC, alongside strong enterprise demand for AI-enabled, policy-enforcing appliances. Europe ranks second, supported by GDPR and NIS2 mandates that require robust endpoint visibility and network segmentation. The fastest-growing region during 2025-2032 will be Asia-Pacific, projected to expand at a CAGR of 25.3%, propelled by rapid digitization in China, India, and Southeast Asia, particularly across manufacturing, BFSI, and public sector deployments. South America follows with a strong growth, driven by increasing NAC investments in critical infrastructure protection and government cybersecurity programs.

Network Access Control (NAC) Hardware Market Analysis by Product Type

NAC appliances account for the largest share of the global NAC hardware market, reflecting their role as the primary enforcement point for large enterprises and data centers that require high-throughput, modular, and rack-mounted configurations. Enforcement gateways/controllers hold the second-largest share, driven by adoption in hybrid environments where policy decisions need to be distributed across multiple network segments. The fastest-growing product category during 2025-2032 will be inline sensors, expanding at a CAGR of 24.8%, fueled by surging demand for passive discovery and continuous monitoring of IoT and OT devices in sectors such as manufacturing, energy, and transportation. Enforcement gateways also post strong growth, as enterprises increasingly deploy them in Zero Trust and Software-Defined Perimeter (SDP) frameworks to enable granular, distributed access control.

Network Access Control (NAC) Hardware Market Analysis by Deployment Type

For 2025, on-premises deployments are forecast to command the majority share. This dominance is underpinned by large enterprises and regulated sectors prioritizing localized policy enforcement for compliance, performance, and integration with existing infrastructure. Cloud-managed NAC hardware, while smaller in absolute size, is set to be the fastest-growing deployment model, expanding at a 25.5% CAGR. Growth in this segment is being fueled by mid-market organizations and distributed enterprises seeking simplified operations, remote management capabilities, and scalable NAC enforcement without extensive on-site resources. Meanwhile, on-premises solutions will also see healthy expansion, sustained by adoption in data-sensitive environments such as government, healthcare, and critical infrastructure.

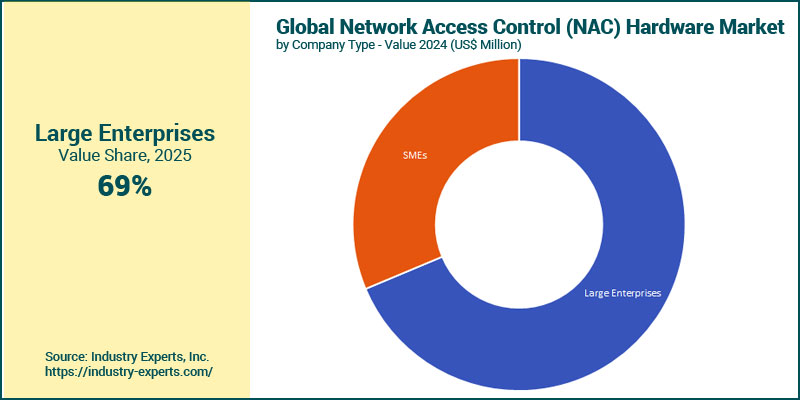

Network Access Control (NAC) Hardware Market Analysis by Company Type

Large enterprises are expected to account for the majority of NAC hardware spending in 2025 at 68.7%, reflecting their extensive investment in high-performance, compliance-ready appliances to secure complex, multi-site networks. SMEs, while representing a smaller base, will register the fastest growth during 2025-2032, reaching US$3.4 billion by the end of the forecast period. This rapid rise is linked to growing cybersecurity awareness, regulatory obligations extending to mid-sized firms, and the availability of more cost-effective, cloud-managed NAC hardware tailored to limited IT resources. Large enterprises will continue to expand, sustained by ongoing Zero Trust initiatives and the integration of NAC appliances into broader security orchestration frameworks.

Network Access Control (NAC) Hardware Market Analysis by Industry Sector

In 2025, IT & telecom will lead NAC hardware spending, fueled by the sector's high device density, rapid 5G rollouts, and the critical need to secure multi-vendor network environments. BFSI follows closely, underpinned by stringent compliance mandates such as PCI DSS 4.0, SWIFT CSP, and national banking cybersecurity frameworks, which demand continuous endpoint verification and secure segmentation. The fastest-growing vertical through 2025-2032 is projected to be BFSI, with a CAGR of 24.7%, as financial institutions increasingly deploy AI-enabled NAC appliances to combat advanced fraud and ransomware threats. Manufacturing is the second fastest-growing segment, driven by the surge in IoT/OT integration, Industry 4.0 deployments, and the need for agentless device visibility in production environments.

Network Access Control (NAC) Hardware Market Report Scope

This global report on Network Access Control (NAC) Hardware market analyzes the global and regional market based on Product Type, Deployment Type, Company Type and Industry Sector for the period 2022-2032 with forecasts from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Analysis Period: | 2022-2032 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 15+ |

Network Access Control (NAC) Hardware Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (Germany, the United Kingdom, France, Italy, the Netherlands, Spain, Russia, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru and Rest of South America)

- Middle East & Africa (the United Arab Emirates, South Africa, Egypt, Saudi Arabia, Morocco, Kuwait, Qatar and Rest of Middle East & Africa)

Network Access Control (NAC) Hardware Market by Product Type

- NAC Appliances

- Enforcement Gateways/Controllers

- Inline Sensors

Network Access Control (NAC) Hardware Market by Deployment Type

- On-Premises

- Cloud-Managed Hardware

Network Access Control (NAC) Hardware Market by Company Type

- Large Enterprises

- SMEs

Network Access Control (NAC) Hardware Market by Industry Sector

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Government & Defense

- Healthcare

- Manufacturing

- Energy & Utilities

- Retail & E-commerce

- Education

- Media & Entertainment

- Transportation & Logistics

- Other Industry Sectors

Network Access Control (NAC) Hardware Market Frequently Asked Questions (FAQs)

Growth is driven by the proliferation of connected devices, stricter regulations (GDPR, NIS2, HIPAA, PCI DSS 4.0), Zero Trust adoption, IoT/OT security needs, and AI-enabled policy enforcement.

North America leads due to stringent compliance frameworks and strong enterprise investment, while Asia-Pacific is the fastest-growing region through 2032.

NAC appliances dominate with over 70% share in 2025, favored by large enterprises and data centers for high-throughput, modular enforcement capabilities.

Inline sensors will grow at the fastest pace (24.8% CAGR) as industries seek passive, agentless monitoring for IoT and OT environments.

On-premises still leads, but cloud-managed NAC hardware is growing faster (25.5% CAGR) due to ease of deployment, scalability, and reduced IT overhead.

IT & telecom leads, closely followed by BFSI, with manufacturing emerging as a high-growth vertical due to Industry 4.0 and IoT expansion.

Key players include Cisco, HPE Aruba, Fortinet, Juniper Networks, Forescout, Huawei, Palo Alto Networks, Check Point, Extreme Networks, and Sophos.

PART A: GLOBAL MARKET PERSPECTIVE

1. EXECUTIVE SUMMARY

- A Roundup on Network Access Control (NAC) Hardware

- Market Segmentation for Network Access Control (NAC) Hardware

- Product Types

- Deployment Types

- Company Types

- Industry Sectors

- Key Trends in Network Access Control (NAC) Hardware Market

2. INDUSTRY LANDSCAPE

- Global Network Access Control (NAC) Hardware Market Outlook

- Comprehensive Network Access Control (NAC) Hardware Industry Analysis - Growth Drivers and Inhibitors

- Growth Drivers

- Growth Inhibitors

- Market Entry Strategies for Network Access Control (NAC) Hardware Industry

- Startup Strategies for Network Access Control (NAC) Hardware Industry

- SWOT Analysis of Network Access Control (NAC) Hardware Industry

- Strengths

- Weaknesses

- Opportunities

- Threats

- Porter's Five Forces Analysis

- PESTEL Analysis

3. COMPETITIVE LANDSCAPE

- Market Positioning of Key Network Access Control (NAC) Hardware Companies

- Market Share Analysis of Network Access Control (NAC) Hardware Companies

- SWOT Analysis of Key Players in the Network Access Control (NAC) Hardware Industry

- Key Market Players

- Alcatel-Lucent Enterprise

- Allied Telesis

- Bradford Networks

- Check Point Software

- Cisco Systems

- Extreme Networks

- Forescout Technologies

- Fortinet

- H3C Technologies

- HPE Aruba Networks

- Huawei

- Juniper Networks

- Palo Alto Networks

- Portnox

- Pulse Secure (Ivanti)

- RUCKUS Networks

- Sophos

- Trend Micro

4. KEY BUSINESS & PRODUCT TRENDS

5. GLOBAL MARKET OVERVIEW

- Global Network Access Control (NAC) Hardware Market Overview by Product Type

- Network Access Control (NAC) Hardware Product Type Market Overview by Global Region

- NAC Appliances

- Enforcement Gateways/Controllers

- Inline Sensors

- Global Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Network Access Control (NAC) Hardware Deployment Type Market Overview by Global Region

- On-Premises

- Cloud-Managed Hardware

- Global Network Access Control (NAC) Hardware Market Overview by Company Type

- Network Access Control (NAC) Hardware Company Type Market Overview by Global Region

- Large Enterprises

- SMEs

- Global Network Access Control (NAC) Hardware Market Overview by Industry Sector

- Network Access Control (NAC) Hardware Industry Sector Market Overview by Global Region

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Government & Defense

- Healthcare

- Manufacturing

- Energy & Utilities

- Retail & E-commerce

- Education

- Media & Entertainment

- Transportation & Logistics

- Other Industry Sectors

PART B: REGIONAL MARKET PERSPECTIVE

- Global Network Access Control (NAC) Hardware Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- North American Network Access Control (NAC) Hardware Market Overview by Geographic Region

- North American Network Access Control (NAC) Hardware Market Overview by Product Type

- North American Network Access Control (NAC) Hardware Market Overview by Deployment Type

- North American Network Access Control (NAC) Hardware Market Overview by Company Type

- North American Network Access Control (NAC) Hardware Market Overview by Industry Sector

- Country-wise Analysis of North American Network Access Control (NAC) Hardware Market

- THE UNITED STATES

- United States Network Access Control (NAC) Hardware Market Overview by Product Type

- United States Network Access Control (NAC) Hardware Market Overview by Deployment Type

- United States Network Access Control (NAC) Hardware Market Overview by Company Type

- United States Network Access Control (NAC) Hardware Market Overview by Industry Sector

- CANADA

- Canadian Network Access Control (NAC) Hardware Market Overview by Product Type

- Canadian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Canadian Network Access Control (NAC) Hardware Market Overview by Company Type

- Canadian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- MEXICO

- Mexican Network Access Control (NAC) Hardware Market Overview by Product Type

- Mexican Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Mexican Network Access Control (NAC) Hardware Market Overview by Company Type

- Mexican Network Access Control (NAC) Hardware Market Overview by Industry Sector

7. EUROPE

- European Network Access Control (NAC) Hardware Market Overview by Geographic Region

- European Network Access Control (NAC) Hardware Market Overview by Product Type

- European Network Access Control (NAC) Hardware Market Overview by Deployment Type

- European Network Access Control (NAC) Hardware Market Overview by Company Type

- European Network Access Control (NAC) Hardware Market Overview by Industry Sector

- Country-wise Analysis of European Network Access Control (NAC) Hardware Market

- GERMANY

- German Network Access Control (NAC) Hardware Market Overview by Product Type

- German Network Access Control (NAC) Hardware Market Overview by Deployment Type

- German Network Access Control (NAC) Hardware Market Overview by Company Type

- German Network Access Control (NAC) Hardware Market Overview by Industry Sector

- THE UNITED KINGDOM

- United Kingdom Network Access Control (NAC) Hardware Market Overview by Product Type

- United Kingdom Network Access Control (NAC) Hardware Market Overview by Deployment Type

- United Kingdom Network Access Control (NAC) Hardware Market Overview by Company Type

- United Kingdom Network Access Control (NAC) Hardware Market Overview by Industry Sector

- FRANCE

- French Network Access Control (NAC) Hardware Market Overview by Product Type

- French Network Access Control (NAC) Hardware Market Overview by Deployment Type

- French Network Access Control (NAC) Hardware Market Overview by Company Type

- French Network Access Control (NAC) Hardware Market Overview by Industry Sector

- ITALY

- Italian Network Access Control (NAC) Hardware Market Overview by Product Type

- Italian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Italian Network Access Control (NAC) Hardware Market Overview by Company Type

- Italian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- THE NETHERLANDS

- Dutch Network Access Control (NAC) Hardware Market Overview by Product Type

- Dutch Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Dutch Network Access Control (NAC) Hardware Market Overview by Company Type

- Dutch Network Access Control (NAC) Hardware Market Overview by Industry Sector

- SPAIN

- Spanish Network Access Control (NAC) Hardware Market Overview by Product Type

- Spanish Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Spanish Network Access Control (NAC) Hardware Market Overview by Company Type

- Spanish Network Access Control (NAC) Hardware Market Overview by Industry Sector

- RUSSIA

- Russian Network Access Control (NAC) Hardware Market Overview by Product Type

- Russian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Russian Network Access Control (NAC) Hardware Market Overview by Company Type

- Russian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- SWITZERLAND

- Swiss Network Access Control (NAC) Hardware Market Overview by Product Type

- Swiss Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Swiss Network Access Control (NAC) Hardware Market Overview by Company Type

- Swiss Network Access Control (NAC) Hardware Market Overview by Industry Sector

- REST OF EUROPE

- Rest of Europe Network Access Control (NAC) Hardware Market Overview by Product Type

- Rest of Europe Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Rest of Europe Network Access Control (NAC) Hardware Market Overview by Company Type

- Rest of Europe Network Access Control (NAC) Hardware Market Overview by Industry Sector

8. ASIA-PACIFIC

- Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Geographic Region

- Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Product Type

- Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Company Type

- Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Industry Sector

- Country-wise Analysis of Asia-Pacific Network Access Control (NAC) Hardware Market

- CHINA

- Chinese Network Access Control (NAC) Hardware Market Overview by Product Type

- Chinese Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Chinese Network Access Control (NAC) Hardware Market Overview by Company Type

- Chinese Network Access Control (NAC) Hardware Market Overview by Industry Sector

- JAPAN

- Japanese Network Access Control (NAC) Hardware Market Overview by Product Type

- Japanese Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Japanese Network Access Control (NAC) Hardware Market Overview by Company Type

- Japanese Network Access Control (NAC) Hardware Market Overview by Industry Sector

- INDIA

- Indian Network Access Control (NAC) Hardware Market Overview by Product Type

- Indian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Indian Network Access Control (NAC) Hardware Market Overview by Company Type

- Indian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- AUSTRALIA

- Australia Network Access Control (NAC) Hardware Market Overview by Product Type

- Australia Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Australia Network Access Control (NAC) Hardware Market Overview by Company Type

- Australia Network Access Control (NAC) Hardware Market Overview by Industry Sector

- SINGAPORE

- Singaporean Network Access Control (NAC) Hardware Market Overview by Product Type

- Singaporean Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Singaporean Network Access Control (NAC) Hardware Market Overview by Company Type

- Singaporean Network Access Control (NAC) Hardware Market Overview by Industry Sector

- SOUTH KOREA

- South Korean Network Access Control (NAC) Hardware Market Overview by Product Type

- South Korean Network Access Control (NAC) Hardware Market Overview by Deployment Type

- South Korean Network Access Control (NAC) Hardware Market Overview by Company Type

- South Korean Network Access Control (NAC) Hardware Market Overview by Industry Sector

- REST OF ASIA-PACIFIC

- Rest of Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Product Type

- Rest of Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Rest of Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Company Type

- Rest of Asia-Pacific Network Access Control (NAC) Hardware Market Overview by Industry Sector

9. SOUTH AMERICA

- South American Network Access Control (NAC) Hardware Market Overview by Geographic Region

- South American Network Access Control (NAC) Hardware Market Overview by Product Type

- South American Network Access Control (NAC) Hardware Market Overview by Deployment Type

- South American Network Access Control (NAC) Hardware Market Overview by Company Type

- South American Network Access Control (NAC) Hardware Market Overview by Industry Sector

- Country-wise Analysis of South American Network Access Control (NAC) Hardware Market

- BRAZIL

- Brazilian Network Access Control (NAC) Hardware Market Overview by Product Type

- Brazilian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Brazilian Network Access Control (NAC) Hardware Market Overview by Company Type

- Brazilian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- ARGENTINA

- Argentine Network Access Control (NAC) Hardware Market Overview by Product Type

- Argentine Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Argentine Network Access Control (NAC) Hardware Market Overview by Company Type

- Argentine Network Access Control (NAC) Hardware Market Overview by Industry Sector

- COLOMBIA

- Colombian Network Access Control (NAC) Hardware Market Overview by Product Type

- Colombian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Colombian Network Access Control (NAC) Hardware Market Overview by Company Type

- Colombian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- CHILE

- Chilean Network Access Control (NAC) Hardware Market Overview by Product Type

- Chilean Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Chilean Network Access Control (NAC) Hardware Market Overview by Company Type

- Chilean Network Access Control (NAC) Hardware Market Overview by Industry Sector

- PERU

- Peruvian Network Access Control (NAC) Hardware Market Overview by Product Type

- Peruvian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Peruvian Network Access Control (NAC) Hardware Market Overview by Company Type

- Peruvian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- REST OF SOUTH AMERICA

- Rest of South America Network Access Control (NAC) Hardware Market Overview by Product Type

- Rest of South America Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Rest of South America Network Access Control (NAC) Hardware Market Overview by Company Type

- Rest of South America Network Access Control (NAC) Hardware Market Overview by Industry Sector

10. MIDDLE EAST & AFRICA

- Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Geographic Region

- Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Product Type

- Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Company Type

- Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Industry Sector

- Country-wise Analysis of Middle East & Africa Network Access Control (NAC) Hardware Market

- THE UNITED ARAB EMIRATES

- United Arab Emirates Network Access Control (NAC) Hardware Market Overview by Product Type

- United Arab Emirates Network Access Control (NAC) Hardware Market Overview by Deployment Type

- United Arab Emirates Network Access Control (NAC) Hardware Market Overview by Company Type

- United Arab Emirates Network Access Control (NAC) Hardware Market Overview by Industry Sector

- SOUTH AFRICA

- South African Network Access Control (NAC) Hardware Market Overview by Product Type

- South African Network Access Control (NAC) Hardware Market Overview by Deployment Type

- South African Network Access Control (NAC) Hardware Market Overview by Company Type

- South African Network Access Control (NAC) Hardware Market Overview by Industry Sector

- EGYPT

- Egyptian Network Access Control (NAC) Hardware Market Overview by Product Type

- Egyptian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Egyptian Network Access Control (NAC) Hardware Market Overview by Company Type

- Egyptian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- SAUDI ARABIA

- Saudi Arabian Network Access Control (NAC) Hardware Market Overview by Product Type

- Saudi Arabian Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Saudi Arabian Network Access Control (NAC) Hardware Market Overview by Company Type

- Saudi Arabian Network Access Control (NAC) Hardware Market Overview by Industry Sector

- MOROCCO

- Moroccan Network Access Control (NAC) Hardware Market Overview by Product Type

- Moroccan Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Moroccan Network Access Control (NAC) Hardware Market Overview by Company Type

- Moroccan Network Access Control (NAC) Hardware Market Overview by Industry Sector

- KUWAIT

- Kuwaiti Network Access Control (NAC) Hardware Market Overview by Product Type

- Kuwaiti Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Kuwaiti Network Access Control (NAC) Hardware Market Overview by Company Type

- Kuwaiti Network Access Control (NAC) Hardware Market Overview by Industry Sector

- QATAR

- Qatari Network Access Control (NAC) Hardware Market Overview by Product Type

- Qatari Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Qatari Network Access Control (NAC) Hardware Market Overview by Company Type

- Qatari Network Access Control (NAC) Hardware Market Overview by Industry Sector

- REST OF MIDDLE EAST & AFRICA

- Rest of Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Product Type

- Rest of Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Deployment Type

- Rest of Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Company Type

- Rest of Middle East & Africa Network Access Control (NAC) Hardware Market Overview by Industry Sector

PART C: INDUSTRY GUIDE

PART D: ANNEXURE

- RESEARCH METHODOLOGY

- FEEDBACK

Alcatel-Lucent Enterprise

Allied Telesis

Bradford Networks

Check Point Software

Cisco Systems

Extreme Networks

Forescout Technologies

Fortinet

H3C Technologies

HPE Aruba Networks

Huawei

Juniper Networks

Palo Alto Networks

Portnox

Pulse Secure (Ivanti)

RUCKUS Networks

Sophos

Trend Micro

Related Reports

| Report | Published | Price |

|---|---|---|

| Content Delivery Network (CDN) - A Global Market Overview | Sep 24, 2025 | $5490 |

| Global AI Consulting and Support Services Market - Service Types, Company Types and Industry Sectors | Sep 23, 2025 | $5490 |

| Application Life-Cycle Management (ALM) Software - A Global Market Overview | Sep 23, 2025 | $5490 |

| Managed Storage Services - A Global Market Overview | Aug 21, 2025 | $5490 |